UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

Schedule

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

________________

|

Filed by the Registrant |

☒ |

|

|

Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

April 10, 2023

Dear Stockholders,

On behalf of the Board of Directors (the “Board”), management, and employees of Gulfport Energy Corporation (“Gulfport”, “Gulfport Energy,” the “Company,” “we,” “our” and “us”), you are cordially invited to participate in the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 24, 2023 at 9:00 a.m. Central Time. Our annual meeting will be held in person at 713 Market Drive, Oklahoma City, OK 73114. The attached Notice of 2023 Annual Meeting of Stockholders and this proxy statement will serve as your guide to the business conducted during the Annual Meeting.

We are mailing most of our stockholders a Notice of Internet Availability of Proxy Materials for the 2023 Annual Meeting (the “Notice”), which provides instructions regarding how stockholders can access and review proxy materials over the internet and submit their proxy electronically. We believe the Notice process allows us to provide our stockholders with the information they desire in a timely manner, while reducing costs and the environmental impact of our Annual Meeting. If you received the Notice and would prefer to receive a paper copy of the proxy materials, please follow the instructions for requesting the materials that are provided in the Notice.

Your vote is very important to us. To assure your representation at the Annual Meeting, please vote your shares over the internet or through the toll-free telephone number as instructed in the Notice.

Thank you for your continued support and interest in Gulfport.

Sincerely,

|

|

|

|

|

Timothy Cutt |

|

Chairman of the Board |

GULFPORT ENERGY CORPORATION

713 Market Drive

Oklahoma City, Oklahoma 73114

|

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS |

April 10, 2023

Notice is given that the 2023 Annual Meeting of Stockholders (including any adjournments or postponements, the “Annual Meeting”) of Gulfport Energy will be held on May 24, 2023 at 9:00 a.m., Central Time at Gulfport Headquarters located at 713 Market Drive, Oklahoma City, OK 73114 to vote on the proposals listed in the following table.

|

Date and Time |

May 24, 2023 at 9:00 a.m., Central Time |

|

Place |

The Annual Meeting will be held in person at Gulfport Headquarters located at 713 Market Drive, Oklahoma City, OK 73114. |

|

Proposals |

1. To elect seven directors to serve until the Company’s 2024 Annual Meeting of Stockholders or until their respective successors have been duly elected and qualified (the Election of Directors Proposal or Proposal 1). 2. To ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for the fiscal year ending December 31, 2023 (the Auditors Ratification Proposal or Proposal 2). 3. To approve, on an advisory, non-binding basis, the compensation paid to the Company’s named executive officers as described in this proxy statement (the Say-On-Pay Proposal or Proposal 3). 4. To approve, on an advisory, non-binding basis, the frequency of advisory stockholder votes on the compensation paid to the Company’s named executive officers (the Say on Frequency Proposal or Proposal 4). We will also transact any other business as may properly come before the Annual Meeting. |

|

Record Date |

March 30, 2023, at the close of business Holders of record of our common stock, par value $0.0001 per share, and preferred stock, par value $0.0001 per share, in each case, outstanding as of March 30, 2023 at the close of business, the record date for the Annual Meeting, will be entitled to Notice of the Annual Meeting and to vote at the Annual Meeting or any adjournment or postponement. |

|

PROXY VOTING |

Stockholders of the Company as of the record date are entitled to vote by proxy in the following ways:

|

By calling the telephone number on your proxy card or voting instruction form |

Online by visiting the website provided on your proxy card or voting instruction form |

By returning by mail a properly |

By attending in person and submitting a ballot at the Annual Meeting |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON May 24, 2023: This proxy statement and additional information are available free of charge on the Company’s website at www.gulfportenergy.com/proxy.

|

By order of the Board of Directors, |

||

|

|

|

|

|

Patrick Craine |

The Notice of Internet Availability of Proxy Materials is first being mailed to stockholders on or about April 14, 2023, and the proxy materials relating to the Annual Meeting will be made available on or about the same date.

|

TABLE OF CONTENTS |

GULFPORT ENERGY CORPORATION

713 Market Drive

Oklahoma City, Oklahoma 73114

_____________________

PROXY STATEMENT

_____________________

|

1 |

|

|

2 |

|

|

3 |

|

|

6 |

|

|

Corporate Governance Matters and Communications with the Board |

15 |

|

Nominating Process for Directors, Director Qualifications and Review of Director Nominees |

17 |

|

19 |

|

|

20 |

|

|

21 |

|

|

23 |

|

|

25 |

|

|

38 |

|

|

39 |

|

|

43 |

|

|

43 |

|

|

43 |

|

|

44 |

|

|

49 |

|

51 |

|

|

52 |

|

|

56 |

|

|

Who Are this Year’s Nominees? |

|

|

57 |

|

Certain Relationships and Review and Approval of Related Party Transactions |

58 |

|

Proposal to Ratify the Appointment of Our Independent Auditors |

59 |

|

60 |

|

|

61 |

|

|

62 |

|

|

63 |

|

|

67 |

|

|

68 |

|

|

69 |

|

|

70 |

|

|

71 |

|

|

72 |

|

|

2023 PROXY STATEMENT i |

The summary below highlights information contained elsewhere in this proxy statement. It does not contain all the information that you should consider in connection with the matters before the Annual Meeting. Please read the entire proxy statement carefully before voting your shares.

|

ABOUT GULFPORT |

Gulfport is an independent natural gas-weighted exploration and production company with assets primarily located in the Appalachia and Anadarko basins. Our principal properties are located in eastern Ohio, where we target development in what is commonly referred to as the Utica formation, and central Oklahoma where we target development in the SCOOP Woodford and Springer formations. Gulfport’s Predecessor was incorporated in the State of Delaware in July 1997. Our corporate headquarters are in Oklahoma City, Oklahoma and shares of Gulfport’s Common Stock trade on the New York Stock Exchange (NYSE) under the ticker symbol “GPOR”.

|

BUSINESS STRATEGY |

Gulfport aims to create sustainable value through the economic development of our significant resource plays in the Utica and SCOOP operating areas. Our strategy is to develop our assets in a manner that generates sustainable cash flow, improves margins and operating efficiencies, while improving our ESG and safety performance. To accomplish these goals, we allocate capital to projects we believe offer the highest rate of return and deploy leading drilling and completion techniques and technologies in our development efforts. We believe our plan to generate free cash flow on an annual basis will allow us to further strengthen our balance sheet, return capital to shareholders and increase our resource depth through incremental leasehold opportunities that provide optionality to our future development plans.

|

Core Assets |

Employees |

2022 Production |

2022 Production Mix |

|

Utica Shale and SCOOP |

223 people |

983 MMcfe |

90% natural gas, 7% natural gas liquids and 3% oil |

|

DIRECTORS |

Our Board is comprised of six directors, including the Company’s Chief Executive Officer, John Reinhart, and five non-employee directors, Timothy Cutt, David Wolf, Guillermo (Bill) Martinez, Jason Martinez and David Reganato. They are diverse, industry-leading experts with an average of approximately 30 years of industry leadership experience across multiple disciplines. Each of our directors will stand for election annually and must be elected by a majority of shares voted.

|

|

2023 PROXY STATEMENT 1 |

The following table provides summary information about each director nominee who is standing for election at the Annual Meeting. For more information about the background and qualifications of each nominee, please see “Election of Directors and Director Biographies” on page 6 of this proxy statement. We ask you to vote “FOR” each of our director nominees.

|

Director |

Board Positions |

Dir. Since |

Age |

Ind. |

Principal Occupation |

|

Timothy Cutt |

Chairman |

2021 |

62 |

Chairman of the Board of Gulfport Energy |

|

|

David Wolf |

Lead Independent Director |

2021 |

52 |

🗸 |

Partner at Enduring Resources |

|

Guillermo (Bill) Martinez |

Independent Director |

2021 |

56 |

🗸 |

Executive Vice President and Chief Operating Officer at Mitsui E&P USA LLC |

|

Jason Martinez |

Independent Director |

2021 |

49 |

🗸 |

Managing Director at Pickering Energy Partners |

|

David Reganato |

Independent Director |

2021 |

43 |

🗸 |

Partner at Silver Point Capital |

|

John Reinhart |

Director |

2023 |

54 |

President and Chief Executive Officer of Gulfport Energy |

|

|

Mary Shafer-Malicki(1) |

Independent Director |

— |

62 |

🗸 |

Director at Callon Petroleum |

____________

(1) The Chairman of the Board recommended Ms. Malicki’s nomination for this position.

|

2 2023 PROXY STATEMENT |

|

Gulfport is proud to play its part in the responsible and efficient development of domestic natural gas which is critical to our country’s economic success as it provides the primary fuel for efficient power generation in the United States. We are aware of the positive influence and potential impact we may have on the communities where we operate and live. Gulfport prioritizes safety, environmental protection, operational excellence and giving back to the communities in which we operate.

We have identified several key areas where our business could have an impact on the communities where we operate, including: greenhouse gas emissions, waste and spills, water usage, health, safety and environmental (“HSE”) protection, employee training and education, and community involvement. Our Board Nominating, Environmental, Social and Governance Committee oversees environmental, safety, social, sustainability and governance (“ESG”) matters. Continuously improving our HSE performance remains a top priority. Our HSE performance also directly impacts the compensation of all our employees as it is one of the performance goals included in our cash incentive compensation plan. We believe having measurable HSE metrics as part of our incentive compensation program leads to improved accountability and reinforces our cultural focus on operating safely and protecting employees, the environment and the communities in which we operate.

Environmental Stewardship. Gulfport strives to minimize the environmental impact of our operations by consistently focusing on finding ways to reduce our environmental footprint. Some of the ways Gulfport minimizes our environmental impact include:

• Selecting and designing our well sites to minimize impacts to sensitive habitats and surrounding areas;

• Reducing water disposal volumes and freshwater consumption through water re-use or water sharing agreements with other operators where possible;

• Investing in and implementing technology to reduce emissions, waste and our physical footprint on our drilling locations;

• Testing spill prevention and response programs to confirm equipment is maintained and operating practices are continually improved to prevent spills and minimize the impact of our operations to the soil, air and water; and

• Employing air quality programs, monitoring and operating practices to ensure that we comply with or exceed regulations.

We are a member of The Environmental Partnership which is committed to continuous improvements in environmental performance, including the reduction of methane and volatile organic compound emissions. Gulfport’s corporate environmental policy supports our commitment to operational excellence and our compliance obligations. The policy fosters environmental awareness and guides employee behavior consistent with Gulfport’s standards. All Gulfport employees are expected to act and make decisions within the guidelines of the policy to ensure our business complies with all local, state and federal environmental laws and regulations. All employees and contractors are expected to protect the environment, minimize and manage waste responsibly, reduce and eliminate emissions and limit spills and discharges.

Safety. Safety is the primary priority for all Gulfport employees and contractors supporting our activities. Gulfport provides comprehensive safety training to all employees and contractors and is fully committed to a safe working environment. We utilize and apply performance metrics to drive and improve safe operations. Gulfport has designed and instituted emergency response and business continuity plans to address incidents involving operational disruptions, pandemics and natural disasters. These measures include prompt notification procedures enabling Gulfport personnel to quickly evaluate and mitigate risks. Limiting safety incidents is included as part of our incentive compensation programs to ensure we train and hold our employees accountable for operating safely.

|

|

2023 PROXY STATEMENT 3 |

|

Corporate Responsibility and Sustainability Highlights |

Gulfport’s Work Safe Program focuses on a combination of twelve rules derived from Company policies (critical tasks) and cultural conditions that have been linked to serious safety incidents in our industry. Critical Task Rules require specific operating procedures to mitigate hazardous work site conditions to complete work safely. Cultural Condition Rules are defined as work site conditions or human behaviors that have been linked to the root cause of most incidents. Employees and contractors are expected to apply and follow the requirements that coincide with the twelve rules. Our goal is to not only improve our safety performance but to proactively prevent incidents before they happen.

Stop Work is one of the Work Safe Program’s critical tasks. Our Chairman and former Chief Executive Officer, Timothy Cutt, signed and communicated a Stop Work Authority and Obligation letter to the Company’s employees and our contractors. This letter outlines Gulfport’s commitment to health, safety and the environment and provides the expectation and support to all Gulfport employees and contract partners to stop work when conditions warrant. Every person on a Gulfport work site has the authority, and obligation to stop any work that is believed to cause an unsafe condition, or places personnel or the environment at risk.

Health, Safety & Environment Highlights for 2022:

• Reduced number of total OSHA recordable injuries by 33% from 2021;

• Reduced reportable spills by 63% year-over-year;

• Continued improving our Contractor Management processes by performing safety audits for new contractors, refreshing safety audits for existing contractors and developing a new contractor orientation video;

• Advanced our WORK SAFE Program using visual aids in the field and ensuring contractor training requirements have been met;

• Created and delivered WORK GREEN Program training on the three focus areas – air, land, and water to reinforce our environmental procedures and policies; and

• Performed a gap assessment on our methane emissions management processes to initiate a gas certification project in Ohio.

Diversity. Diversity and inclusion are paramount to our organization. We obtained 100% compliance across our Company in diversity and inclusion training. Diversity is also important at our Board level, where over 40% of our directors to identify as gender or ethnically diverse. We are also committed to supporting veterans and do so through our recruiting and hiring efforts as well as supporting several causes that assist veterans and active-duty military.

Community Engagement. Gulfport consistently strives to positively impact and improve the communities where we live and operate. We uphold our corporate responsibility and put our core tenets into action by forming partnerships that are impactful in our operating areas. We have created a Community Impact Strategy that focuses our volunteering and giving efforts supporting education, health and human services, environmental stewardship, and veterans.

In 2022, we completed a multi-year pledge to the Dolly Parton Imagination Library supporting multiple counties in our Ohio operating area by providing literacy support for young children. We also continued our partnership with the River Protectors in Oklahoma by volunteering to remove trash on the North Canadian River. The River Protectors is an organization that works to remove trash as it arrives on riverbanks and focuses on driving a cultural shift to eliminate the problem.

|

4 2023 PROXY STATEMENT |

|

|

Corporate Responsibility and Sustainability Highlights |

|

Corporate Governance Highlights |

We believe effective corporate governance requires regular constructive discussions with our stockholders. We have a proactive engagement process that encourages feedback from our stockholders. This feedback helps shape our corporate governance practices, and has specifically resulted in:

|

• Amendment of the Bylaws to change the supermajority vote requirement for stockholders to amend the Bylaws to a majority vote requirement; • Adoption of stock ownership guidelines for our non-employee directors and executive officers to further align the long-term financial interests of our directors and executive officers with those of our stockholders; • Adoption of Corporate Governance Guidelines to ensure best practices and reflect the Board’s commitment to monitor the effectiveness of policy and decision making at the Board and management levels; • Separation of Chief Executive Officer and Chairman roles on January 24, 2023; • Lead Independent Director appointed; • Advancement of Board diversity, emphasis on diversity in the Nominating, Environmental, Social and Governance Committee’s charter; |

• Majority voting to elect directors in uncontested elections and plurality voting to elect directors in contested elections; • Creation of the Nominating, Environmental, Social and Governance Committee to further develop our commitment to HSE and corporate responsibility and sustainability matters and their impact on our business and operations; • Active stockholder outreach, engaging in discussions with our stockholders at investor conferences and through direct calls and meetings with the Company’s management team that represent approximately 75% of the shares outstanding; • Active Board oversight of risk and risk management; • Periodic Board and Committee self-assessments reviewed by an outside law firm; • Non-employee director meetings in executive sessions at regularly scheduled Board meetings; and • 94% attendance at 2022 Board and Committee meetings. |

|

COMPENSATION HIGHLIGHTS |

Stockholder Engagement and Annual Say-On-Pay Advisory Vote

At the Annual Meeting, our stockholders will again have an opportunity to cast an advisory Say-On-Pay vote on the compensation paid to our named executive officers as described in this proxy statement. The details of the executive compensation program and its pay for performance alignment are discussed in the “Compensation Discussion & Analysis (CD&A)” on page 23 of this proxy statement.

Gulfport Energy has engaged in discussions with our stockholders at investor conferences and through direct calls and meetings with the Company’s management team that represented approximately 75% of the shares outstanding. Through these conversations our stockholders emphasized their expectation that our compensation programs should be designed to focus our executive team on driving results that ensure the financial health of the organization while also driving long-term stockholder value. Specifically, after carefully considering input from stockholders, the Company took the following actions in 2022:

• Utilized performance-based and time-based equity awards in the form of performance-based restricted stock units tied to relative total shareholder return (“TSR”) and absolute return, vesting over a three-year performance period in 2022; 60% of all equity awards to NEOs were performance-based;

• Adjusted performance incentive opportunities and long-term equity award targets to closely align our executives’ financial interests with those of our stockholders and to continue to link a large portion of executives’ compensation to the performance of our stock and our operational performance;

• Modified metrics in the annual incentive plan to include financial metrics directly tied to the financial health of the Company, including production per day, capital expenses, lease operating expenses, free cash flow generation, and specific and quantifiable health, safety, environmental and social metrics; and

• Provided robust disclosure of our performance metrics and targets for both performance-based cash and equity awards.

|

|

2023 PROXY STATEMENT 5 |

The Company is asking its stockholders to vote to elect seven directors to serve on the Board of Directors until the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) or until their respective successors have been duly elected and qualified.

Our Board of Directors currently consists of six members who are elected annually. Five of these six directors are non-employee directors, and four of the six directors are independent under the NYSE listing standards.

The directors standing for election this year are listed below. If any nominee should decline election or should become unable to serve as a director of our Company for any reason before election at the Annual Meeting, votes will be cast by the persons appointed as proxies for a substitute nominee, if any, designated by the Board of Directors.

There are no family relationships among any of the nominees, directors or any of the executive officers.

Vote Required and Board Voting Recommendation

Directors will be elected at the Annual Meeting by a majority of the votes cast. Abstentions and broker non-votes will have no effect on the voting results for Proposal 1.

|

6 2023 PROXY STATEMENT |

|

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

Timothy Cutt |

||

|

Age: 62 Director since: May 2021 Other Public Company Directorships Held in the Past Five Years: QEP (January 2019 – March 2021) Cobalt (July 2016 – April 2018) |

Business Experience: Mr. Cutt has served as non-executive Chairman of the Board since March 2023 and joined Gulfport as Chairman of the Board and Interim Chief Executive Officer in May 2021 and assumed the role of Chief Executive Officer in September 2021. Mr. Cutt is a Petroleum Engineer with over 40 years of energy experience. He served as Chief Executive Officer and as a director of QEP Resources from January 2019 to March 2021. Prior to joining QEP, Mr. Cutt was the Chief Executive Officer and a director of Cobalt International Energy from 2016 to 2018. Previously, Mr. Cutt held several executive positions with BHP Billiton before serving as President of the Petroleum Division from 2013 to 2016. During this time, he was also a member of BHP Billiton’s Corporate Leadership Team. Mr. Cutt began his career with Mobil and worked for ExxonMobil for 24 years and served in various management roles including President of ExxonMobil de Venezuela, President ExxonMobil Canada Energy and President Hibernia Management & Development Company. Other Memberships and Positions: Mr. Cutt joined the board of the American Exploration and Production Council in May 2021 and previously served as a board member of the American Petroleum Institute from 2013 to 2018. Educational Background: Mr. Cutt received his Bachelor of Science Degree in Petroleum Engineering from Louisiana Tech University. BOARD MEMBERSHIP QUALIFICATIONS: Mr. Cutt’s extensive experience as a CEO and director of public exploration and production companies, executive management skills and extensive knowledge of the oil and natural gas sector and corporate governance qualify him to serve as a director. |

|

|

|

|

|

|

David Wolf |

||

|

Age: 52 Director since: May 2021 Other Public Company Directorships Held in the Past Five Years: EP Energy Corporation (Since October 2020) |

Business Experience: Mr. Wolf serves as Lead Independent Director and has an extensive financial background, with over 28 years of experience in the energy and oil and gas industries. Currently, Mr. Wolf serves as a partner at Enduring Resources. He previously served as Executive Vice President and Chief Financial Officer of Vantage Energy and President, Chief Executive Officer, and a Board Member of Fuse Energy LLC. Prior to joining Fuse Energy, Mr. Wolf served as Executive Vice President and Chief Financial Officer of Berry Petroleum Co and a Managing Director in the Global Oil & Gas Group at JP Morgan Chase & Co. Educational Background: Mr. Wolf received his Bachelor of Science degree in Economics from Rollins College and Master of Business Administration degree from Crummer School of Business, Rollins College. BOARD QUALIFICATIONS: Mr. Wolf’s prior experience as a Chief Financial Officer, strong oil and natural gas industry background and financial acumen qualify him to serve as a director. |

|

|

|

2023 PROXY STATEMENT 7 |

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

Guillermo (Bill) Martinez |

||

|

Age: 56 Director since: May 2021 |

Business Experience: Mr. Martinez has more than 30 years of upstream oil and gas experience, beginning his career in Midland, Texas working for Exxon then ExxonMobil. Currently, Mr. Martinez serves as Executive Vice President and Chief Operating Officer at Mitsui E&P USA LLC. He joined Mitsui E&P USA in 2019 as Senior Vice President of Operations to help guide Mitsui’s efforts to transform and grow its upstream operations. Previously, Mr. Martinez worked for Burlington Resources, Anadarko Petroleum and Chesapeake Energy in various leadership roles responsible for asset management and business delivery for a variety of assets including many US onshore basins, Continental Shelf, and Deepwater Gulf of Mexico. Mr. Martinez began his career with Exxon and held various operational, technical, and business roles of increasing responsibility. Educational Background: Mr. Martinez received his engineering degree from the University of Texas – El Paso and his Master of Business Administration degree from Rice University in Houston. BOARD QUALIFICATIONS: Mr. Martinez’s strong oil and natural gas background and financial acumen qualify him to serve as a director. |

|

|

Jason Martinez |

||

|

Age: 49 Director since: May 2021 |

BUSINESS EXPERIENCE: Mr. Martinez has had a 27-year energy industry career, and over 20 years as an investment banker. Currently, Mr. Martinez serves as a Managing Director at Pickering Energy Partners, leading its Energy Transition Advisory practice. Over the course of his career, his client and deal work span a dozen-plus countries and over $100 billion of announced transactions, including mergers, acquisitions, divestitures, all forms of public and private capital raising, and commercial lending. Previously, he held positions at Bank of Montreal Capital Markets, Nomura Securities International, Deutsche Bank Securities, and JPMorgan Securities. At Bank of Montreal, he led the Acquisitions and Divestitures practice. He began his energy career in Andersen Consulting’s Natural Resources group. EDUCATIONAL BACKGROUND: Mr. Martinez received his Master of Business Administration degree from the Harvard Business School and a Bachelor of Arts degree from Rice University. BOARD QUALIFICATIONS: Mr. Martinez’s financial acumen and extensive private equity experience qualify him to serve as a director. |

|

|

|

|

|

|

8 2023 PROXY STATEMENT |

|

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

David Reganato |

||

|

Age: 43 Director since: May 2021 Other Public Company Directorships Held in the Past Five Years: Rotech Healthcare Holdings, Inc. (since September 2013) Studio City International Holdings (since March 2014) New Cotai, LLC (since March 2014) Trident Holding Company, LLC, (since September 2019) Granite Broadcasting LLC (since July 2011) |

Business Experience: Mr. Reganato has over 20 years of experience in the investment industry, including significant knowledge of the oil and gas sector. Currently, Mr. Reganato serves as a Partner with Silver Point Capital, L.P., an investment advisor, which he joined in November 2002. Prior to Silver Point Capital, L.P., Mr. Reganato worked in the investment banking division of Morgan Stanley. Educational Background: Mr. Reganato received his Bachelor of Science degree in Finance and Accounting from the Stern School of Business at New York University. BOARD QUALIFICATIONS: Mr. Reganato’s financial acumen, knowledge of the oil and natural gas sector and previous board experience qualify him to serve as a director. |

|

|

John Reinhart |

||

|

Age: 54 Director since: January 2023 Other Public Company Directorships Held in the Past Five Years: Montage Resources (March 2019 – November 2020) Blue Ridge Mountain Resources Inc. (January 2017 – March 2019) |

BUSINESS EXPERIENCE: Mr. Reinhart has over 20 years of oil and gas industry leadership experience. Most recently, he served as President, Chief Executive Officer and member of the board of directors of Montage Resources Corporation where he led actions that positioned Montage as an attractive strategic partner with sufficient scale, low debt profile and achievement of top-quartile operational and financial metrics. Mr. Reinhart previously served as President, Chief Executive Officer and member of the board of directors of Blue Ridge Mountain Resources and as Chief Operating Officer at Ascent Resources. He started his oil and gas career at Schlumberger before joining Chesapeake Energy Corporation, where he held operations roles with increasing responsibility. Mr. Reinhart began his career in the United States Army, serving tours in Panama and Iraq. Educational Background: Mr. Reinhart graduated from West Virginia University with a Bachelor of Science degree in Mechanical Engineering. BOARD QUALIFICATIONS: Mr. Reinhart’s considerable operational, technical, cultural, and executive experience in the oil and natural gas industry, including his prior service as an executive and director of both Montage Resources and Blue Ridge Mountain Resources qualify him to serve as a director. |

|

|

|

2023 PROXY STATEMENT 9 |

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

Mary Shafer-Malicki |

||

|

Age: 62 Other Public Company Directorships Held in the Past Five Years: Callon Petroleum (Since January 2022) QEP Resources (July 2017 – March 2021) McDermott International Inc. (November 2011 – May 2020) |

BUSINESS EXPERIENCE: Ms. Shafer-Malicki retired in 2009 after a 26-year career with BP Exploration Operating Company (BP) and Amoco Corporation, where she held domestic and international leadership roles across the energy value chain. She served as Senior Vice President/CEO and Chief Operating Officer/General Manager for BP’s operations in Angola from 2005 to 2009 and Director General for BP’s operations in Vietnam from 2003 to 2005. Prior to this, she served as the Business Unit Leader for BP’s Central North Sea gas business in Scotland from 2001 to 2003, General Manager for support services to all of BP’s Continental Shelf upstream operations in the United Kingdom from 2000 to 2001 and President and General Manager for Amoco/BP’s Dutch onshore and offshore production and gas storage operations in the Netherlands from 1998 to 2000. Her significant board experience includes service as Chair of the Board for QEP Resources and as a board member for Wood plc, McDermott International Inc., and Ausenco Limited. In addition, Ms. Shafer-Malicki currently serves as a director of Callon Petroleum, the University of Wyoming Foundation, as well as a member of industry advisory boards for the Chemical Engineering departments at the University of Wyoming and Oklahoma State University. Educational Background: Ms. Shafer-Malicki graduated from Oklahoma State University with a Bachelor of Science degree in Chemical Engineering. BOARD QUALIFICATIONS: Ms. Shafer-Malicki’s extensive energy industry experience, including her serving in senior executive positions, and her experience as a director on multiple public company boards qualify her to serve as a director. |

|

|

10 2023 PROXY STATEMENT |

|

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

WHAT ARE THE COMMITTEES OF THE BOARD? |

Our Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating, Environmental, Social and Governance Committee. The table below summarizes committee membership as of the date of this proxy statement along with the functions each committee is responsible for performing.

|

AUDIT COMMITTEE |

|

|

Members David Wolf C+^ Guillermo (Bill) Martinez + Jason Martinez +^ David Reganato +^ Number of Meetings in 2022 8 |

Principal Functions • Reviews and discusses with management and the independent auditors the integrity of our accounting policies, internal controls, financial statements, accounting and auditing processes and risk management compliance. • Monitors and oversees our accounting, auditing and financial reporting processes generally, including the qualifications, independence and performance of the independent auditor. • Monitors our compliance with legal and regulatory requirements. • Monitors compliance with the Company’s Code of Business Conduct and Ethics. • Establishes and oversees procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. • Reviews and approves related party transactions. • Appoints, determines compensation, evaluates and terminates our independent auditors. • Pre-approves audit and permissible non-audit services to be performed by the independent auditors. • Prepares the report required by the U.S. Securities and Exchange Commission (the “SEC”), for the inclusion in our annual proxy statement. • Reviews and reassesses the adequacy of the Audit Committee charter on a periodic basis. • Informs our independent auditors of the Audit Committee’s understanding of significant relationships and transactions with related parties and review and discuss with our independent auditors the auditors’ evaluation of our identification of, accounting for and disclosure of our relationships and transactions with related parties, including any significant matters arising from the audit regarding our relationships and transactions with related parties. |

C Committee Chairperson.

+ Satisfies NYSE independence and other applicable independence rules for membership on such Committees.

^ Audit Committee financial expert.

|

|

2023 PROXY STATEMENT 11 |

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

compensation committee |

|

|

Members Jason Martinez C+ David Wolf + Guillermo (Bill) Martinez + David Reganato + Number of Meetings in 2022 5 |

Principal Functions • Oversees and administers our executive compensation policies, plans and practices, including our stock retention guidelines, and evaluates their impact on risk and risk management. • Assists the Board of Directors in discharging its responsibilities relating to the compensation of our executives, including our Chief Executive Officer, and other key employees. • Administers our equity-based compensation plans, including the grants of stock options, restricted stock awards and other equity awards under such plans. • Develops, reviews and approves our cash-based incentive bonus plans, including the establishment of performance criteria, targets and awards under our 2022 Executive Annual Incentive Compensation Plan. • Makes recommendations to the Board with respect to incentive compensation. • Where appropriate or required, makes recommendations to our stockholders with respect to incentive compensation and equity-based plans. • Conducts annual performance evaluation of the Committee. • Reviews disclosure related to executive compensation in our proxy statement and prepares an annual Compensation Committee report. • Reviews and considers the stockholders’ advisory vote on executive compensation and the frequency of holding such advisory vote. • Reviews and reassesses the adequacy of the Compensation Committee charter. |

C Committee Chairperson.

+ Satisfies NYSE independence and other applicable independence rules for membership on such Committees.

|

12 2023 PROXY STATEMENT |

|

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

NOMINATING, ENVIRONMENTAL, SOCIAL AND GOVERNANCE COMMITTEE |

|

|

Members Guillermo (Bill) Martinez C+ David Wolf + Jason Martinez + David Reganato + Number of Meetings in 2022 5 |

Principal Functions • Assists the Board of Directors in developing criteria for identifying and evaluating individuals qualified to serve as members of our Board of Directors. • Selects and recommends director candidates to the Board of Directors to be submitted for election at each annual meeting of stockholders and to fill any vacancies on the Board of Directors. • Periodically reviews and makes recommendations regarding the composition and size of the Board of Directors and its Committees. • Reviews and recommends to the Board of Directors appropriate corporate governance guidelines and procedures for the Company. • Conducts an annual assessment of the qualifications and performance of the Board of Directors. • Reviews and reports to the Board of Directors on the performance of management annually. • Reviews the development and leadership capabilities of the executive officers and management’s succession process. • Reviews and makes recommendations to our Board of Directors regarding the health, safety and environmental protection, and corporate responsibility matters, including governmental relations, political contributions and corporate philanthropy, which we refer to as HSE and corporate responsibility matters, and their impact on our business and operations. • Monitors and evaluates management’s actions with respect to HSE and corporate responsibility matters. • Reviews reports from our management, consultants or other advisors regarding (i) our performance with respect to HSE and corporate responsibility matters and compliance with any related laws and regulations applicable to us, (ii) any significant litigation relating to HSE and corporate responsibility matters involving our Company, and (iii) any significant legislation or regulations, judicial decisions, treaties, protocols, conventions or other agreements, public policies or other scientific, medical or technological developments involving HSE and corporate responsibility matters that will or may have a material effect on our business and operations. • Reviews the risks and exposures relating to HSE and corporate responsibility matters, including mitigation and remedial actions. • Reviews crisis management planning procedures relating to HSE and corporate responsibility matters. • Conducts investigations or studies affecting Gulfport as they pertain to HSE and corporate responsibility matters. • Reviews the effectiveness of internal systems and controls necessary to ensure our compliance with applicable health, safety and environmental laws, rules and regulations. • Reviews our compliance with industry practices in the areas of health, safety and environmental protection. • Reviews our political, charitable and educational contributions/programs and the administration of any political action or similar Committees of our employees. • Oversees the policies and practices promoting diversity and inclusion within the Company and the Company’s human and workplace rights and policies. • Reviews and provides guidance on public policy advocacy efforts to confirm alignment with Company policies and values. • Reviews and reassesses the adequacy of the Nominating, Environmental, Social and Governance Committee charter. |

C Committee Chairperson.

+ Satisfies NYSE independence and other applicable independence rules for membership on such Committees.

|

|

2023 PROXY STATEMENT 13 |

|

ELECTION OF DIRECTORS AND DIRECTOR BIOGRAPHIES |

|

DO THE COMMITTEES HAVE WRITTEN CHARTERS? |

Yes. The charters for each Committee can be found on our website at www.gulfportenergy.com under the “Investors — Governance” captions. You may also obtain copies of these charters, as well as our Code of Business Conduct and Ethics, which is described below, by writing to our Chief Legal and Administrative Officer and Corporate Secretary, Patrick Craine, at Gulfport Energy Corporation, 713 Market Drive, Oklahoma City, Oklahoma 73114.

|

14 2023 PROXY STATEMENT |

|

|

WHO ARE OUR INDEPENDENT DIRECTORS? |

Our Board of Directors has determined that four of our six current Board members (David Wolf, Guillermo (Bill) Martinez, Jason Martinez and David Reganato) meet the independence requirements in the NYSE listing standards and are free of any relationship that, in the opinion of our Board of Directors, would interfere with the exercise of independent judgment in carrying out their responsibilities as directors of the Company. Mr. Reinhart, our Chief Executive Officer and Director, is not considered by the Board of Directors to be an independent director because of his current employment with the Company. Mr. Cutt, our Chairman of the Board, is not considered by the Board of Directors to be an independent director because of his previous employment as Chief Executive Officer of the Company. Our Board is currently over 33% diverse, and it will be over 40% diverse with the addition of one new female director nominee.

|

Annual Board Self-Assessment Process |

Board and Committee Evaluations

Director Performance Evaluations

|

How often did the Board of Directors meet in 2022? |

The Board of Directors met 14 times in 2022. In addition to these meetings, the Board of Directors adopted resolutions by unanimous written consent. Each director attended over 85% of the aggregate meetings of the Board of Directors and the meetings of the Committees on which he served.

|

Do our non-management directors meet separately without management? |

Our non-management directors routinely meet in an executive session following regularly scheduled meetings of the Board of Directors.

|

|

2023 PROXY STATEMENT 15 |

|

CORPORATE GOVERNANCE MATTERS AND COMMUNICATIONS WITH THE BOARD |

|

How can I communicate with the Board of Directors? |

Individuals may communicate with our Board of Directors or individual directors by writing to our Chief Legal and Administrative Officer and Corporate Secretary, Patrick Craine, at Gulfport Energy Corporation, 713 Market Drive, Oklahoma City, Oklahoma 73114. Our Chief Legal and Administrative Officer and Corporate Secretary will review all correspondence and forward our Board of Directors correspondence that, in the opinion of our Chief Legal and Administrative Officer and Corporate Secretary, relates to the function of our Board of Directors or a Board Committee or otherwise requires their attention. Directors may review a log of all correspondence received by us and request copies. Concerns relating to accounting, internal control over financial reporting or auditing matters will be immediately brought to the attention of the chairman of the Audit Committee and handled in accordance with our Audit Committee’s procedures.

|

WILL directors attend the Annual Meeting? |

Recognizing that director attendance at our Annual Meeting can provide stockholders an opportunity to communicate with directors about issues affecting the Company, we actively encourage our directors to attend the Annual Meeting of Stockholders. All Directors attended our 2022 Annual Meeting of Shareholders.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics designed to help directors and employees resolve ethical issues. Our Code of Business Conduct and Ethics applies to all directors and employees. Our Code of Business Conduct and Ethics covers various topics including, but not limited to, conflicts of interest, fair dealing, discrimination and harassment, confidentiality, compliance procedures and employee complaint procedures. Our Code of Business Conduct and Ethics, together with any amendments or waivers, is posted on our website at www.gulfportenergy.com under the “Investors – Governance” captions.

Political Contribution Policy

Engagement in the political, legislative and regulatory process is important to the success of the Company. The Company has delegated compliance and oversight over this function to the Nominating, Environmental, Social and Governance Committee and has adopted a political contributions and activity policy that sets forth the ways by which the Company and its employees may participate in the political, legislative and regulatory process. All political contributions and activities are subject to compliance with applicable laws.

|

16 2023 PROXY STATEMENT |

|

Director Qualifications

As provided by the Nominating, Environmental, Social and Governance Committee’s charter, the Committee identifies, investigates and recommends candidates to our Board of Directors with the goal of creating a balance of knowledge, experience and diversity. The Committee identifies candidates using third-party search firms, as well as through the extensive networks of our directors and management team in the oil and natural gas industry.

It is our policy that potential directors should possess the highest personal and professional ethics, integrity and values and be committed to representing the interests of our stockholders. In addition to reviewing a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of our Board of Directors, the skills necessary to provide effective oversight in critical areas and the evolving needs of our business. It is the policy of our Board of Directors that, at all times, at least a majority of its members meets the standards of independence promulgated by the NYSE and the SEC and that its members reflect a range of talents, skills and expertise, particularly in the areas of accounting and finance, management, leadership and oil and gas-related industries sufficient to provide sound and prudent guidance with respect to our operations and the interests of our stockholders.

Board Diversity Policy

Our Nominating, Environmental, Social and Governance Committee is dedicated to diversity and adopted a Board Diversity Policy in November 2019. The policy requires that the Nominating, Environmental, Social and Governance Committee consider diversity in its evaluation of candidates for Board membership. Our Nominating, Environmental, Social and Governance Committee, in accordance with its charter, seeks to include diverse candidates in all director searches, taking into account diversity of gender, race, ethnicity, background, age, thought and tenure on our Board (in connection with the consideration of the renomination of an existing director), including by affirmatively instructing any search firm retained to assist the Nominating, Environmental, Social and Governance Committee in identifying director candidates to include diverse candidates from traditional and non-traditional candidate groups. In accordance with its charter, our Nominating, Environmental, Social and Governance Committee periodically reviews and makes recommendations regarding the composition of the Board and the size of the Board.

We also require that the members of our Board of Directors be able to dedicate the time and resources sufficient to ensure the diligent performance of their duties on our behalf, including attending meetings of the Board of Directors and applicable Committee meetings. In accordance with its charter, our Nominating, Environmental, Social and Governance Committee periodically reviews the criteria for the selection of directors to serve on our Board and recommends any proposed changes to our Board of Directors for approval.

Nomination Process

Our Board of Directors will consider stockholder nominations for director candidates upon written submission to our Chief Legal and Administrative Officer and Corporate Secretary along with, among other things, the nominee’s qualifications and certain biographical information regarding the nominee, the nominee’s written consent to serve as a director if elected and being named in the proxy or information statement and information regarding the status of the stockholder submitting the recommendation, all in the manner required by the Second Amended and Restated Bylaws of the Company (the “Bylaws”) and the applicable rules and regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by our Board of Directors at a regularly scheduled or special Board meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, materials will be forwarded to our Board of Directors. See “Submission of Future Stockholder Proposals” below for additional detail regarding submitting director nominees.

|

|

2023 PROXY STATEMENT 17 |

|

NOMINATING PROCESS FOR DIRECTORS, DIRECTOR QUALIFICATIONS AND REVIEW OF DIRECTOR NOMINEES |

Our Board of Directors may also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder. In evaluating nominations, our Board of Directors will seek to achieve a balance of knowledge, experience and diversity on the Board. To be nominated to serve as a director, a nominee need not meet any specific minimum criteria. Our Board of Directors uses the same criteria for evaluating candidates nominated by stockholders as it does for those proposed by current Board members, professional search firms and other people. After completing its evaluation, our Board of Directors approves the final slate of director nominees.

Our Nominating, Environmental, Social and Governance Committee approved the director nominees submitted for election at the Annual Meeting. Each nominee brings a strong and unique background and set of skills to our Board of Directors, giving our Board of Directors competence and experience in a variety of areas, including corporate governance and Board service, executive management, the oil and natural gas industry, accounting and finance and risk assessment and management.

|

18 2023 PROXY STATEMENT |

|

Chairman

Timothy Cutt was appointed interim CEO in addition to his role as Chairman in mid-2021. In September 2021 the Board appointed Mr. Cutt as CEO on a permanent basis in addition to his role as Chairman.

Effective January 24, 2023, the positions of Chairman of the Board and Chief Executive Officer are held by two different individuals, and the Chairman of the Board is a non-executive position elected from among the directors by the Board. Separating the positions of Chairman of the Board and Chief Executive Officer allows our Chief Executive Officer to focus on business development strategies as well as our day-to-day business and operations, while allowing our Chairman of the Board to lead the Board in its fundamental role of providing advice to and oversight of management. The Chairman of the Board provides leadership to our Board of Directors and works with the Board of Directors to define its structure and activities in the fulfillment of its responsibilities.

The duties of the non-executive Chairman of the Board include:

• Presiding at meetings of our Board of Directors and stockholders;

• Setting Board agendas with input from other members of the Board and our management;

• Facilitating communication among, and information flow to, directors;

• Calling special meetings of our Board of Directors and stockholders; and

• Advising and counseling our Chief Executive Officer and other officers.

Lead Independent Director

The Board has appointed Mr. Wolf to serve as lead director with responsibilities typically performed by an independent Chairman, including acting as chair at meetings of the Board of Directors when the Chairman is not present.

Directors

We believe that our directors bring a broad range of leadership experience to the boardroom and regularly contribute to the thoughtful discussion involved in effectively overseeing the business and affairs of the Company. We believe that the atmosphere of our Board is collegial, that all Board members are well engaged in their responsibilities and that all Board members express their views and consider the opinions expressed by other directors. Five out of seven director nominees are independent under NYSE listing standards and SEC rules. We believe that our independent directors have demonstrated leadership in business enterprises and are familiar with Board processes. Our independent directors are involved in the leadership structure of our Board by serving on our Audit, Nominating, Environmental, Social and Governance and Compensation Committees, comprised entirely of independent directors and each having an independent chairperson.

Committee Chairs

Specifically, our Audit Committee Chair oversees the accounting and financial reporting processes and compliance with legal and regulatory requirements. Our Compensation Committee Chair oversees our compensation policies and practices and their impact on risk and risk management. The Chair of our Nominating, Environmental, Social and Governance Committee oversees our practices relating to health, safety and environmental protection, as well as social and governance matters. Our Nominating, Environmental, Social and Governance Committee Chair also monitors matters related to Board and Committee composition, Board performance and best practices in corporate governance. Each Committee Chair provides independent leadership for the purposes of many important functions delegated by our Board of Directors to such Committee.

|

|

2023 PROXY STATEMENT 19 |

While our management team is responsible for the day-to-day management of risks, the Board of Directors has primary responsibility for risk oversight. Boards typically exercise this oversight during regular Board meetings, but our Board of Directors also maintains constant and open dialogue with management and reviews and monitors key processes. As a result, they are better able to respond to emerging risks and to influence our strategy to address those risks.

While our Board of Directors is responsible for risk oversight at the Company, our three Committees assist the Board in fulfilling its oversight responsibilities in the areas of risk below:

|

Committee |

Risk Areas of Focus |

|

Audit |

• Cybersecurity • Financial Reporting • Internal Controls • Legal Compliance • Regulatory Compliance • Reserves Reporting • Risk Management |

|

Compensation |

• Compensation Policies • Executive Performance |

|

Nominating, Environmental, Social and Governance |

• Board Organization • Corporate Governance • Environment • Government Relations • Membership • Political Contributions • Public Health • Safety • Structure • Succession Planning |

|

20 2023 PROXY STATEMENT |

|

The following table sets forth the name, age, positions and business experience of each of our executive officers (other than John Reinhart, who also serves as a member of our Board and who is listed under “Election of Directors and Director Biographies”):

|

NAME |

POSITIONS AND EXPERIENCE |

|

Michael Hodges |

Executive Vice President, Chief Financial Officer since April 2023 Prior to joining the Company, Mr. Hodges served as Senior Vice President, Finance and Accounting at Leon Capital Group. Prior to joining Leon Capital, he was the Executive Vice President and Chief Financial Officer for Montage Resources Corporation until its merger with Southwestern Energy Company in November 2020. From 2012 until joining Montage Resources in 2018, Mr. Hodges served as the Chief Financial Officer for three upstream energy companies focused on near-term value creation through the acquisition and early-stage development of oil and natural gas resources. Mr. Hodges received his Bachelor of Business Administration in Finance from the University of Oklahoma and a Master of Science in Energy Management from Oklahoma City University and is a Certified Public Accountant in the State of Oklahoma. |

|

Patrick Craine |

Executive Vice President, Chief Legal and Administrative Officer since June 2021 Mr. Craine joined Gulfport as Executive Vice President, General Counsel and Corporate Secretary in May 2019. Mr. Craine has over 25 years of extensive senior-level experience handling a broad range of securities, corporate, regulatory, governance, compliance and litigation matters, with particular expertise in the energy industry. He joined Gulfport from Chesapeake Energy Corporation (NYSE: CHK) (“Chesapeake”), a hydrocarbon exploration company, where he served as Deputy General Counsel – Chief Risk and Compliance Officer from 2013 until 2019. Prior to joining Chesapeake, Mr. Craine was a partner with Bracewell LLP, a global law firm, where his practice focused on securities and corporate regulatory matters and investigations. Before Mr. Craine entered private practice, he served as a lawyer with the SEC and the Financial Industry Regulatory Authority, where he held leadership positions in their Oil and Gas Task Forces. Mr. Craine received his Bachelor of Arts degree, summa cum laude, Phi Beta Kappa, from Wabash College, and his Juris Doctorate, cum laude, from the Southern Methodist University Dedman School of Law. |

|

Matthew Rucker |

Senior Vice President, Operations since March 2023 Prior to joining the Company, Mr. Rucker served as Vice President, Production Operations of Javelin Energy Partners since August 2022. He joined Javelin in July 2022 as the Vice President of Business Development. Prior to joining Javelin, Mr. Rucker served as the Executive Vice President, Chief Operating Officer of Montage Resources Corporation following Montage’s successful business combination transaction with Blue Ridge Mountain Resources in June 2020. Prior to Montage, Mr. Rucker served as Vice President, Resource Planning and Development of Blue Ridge from 2016 to 2020. Prior to joining Blue Ridge, Mr. Rucker served as a Production Superintendent for Chesapeake Energy Corporation from January 2014 to October 2016, overseeing Chesapeake’s Utica Shale production. As a member of Chesapeake’s Eastern Division leadership team, Mr. Rucker focused on the safe and efficient optimization of production in the Utica Shale and led an operating team of over 45 employees. During his service at Chesapeake, Mr. Rucker held several engineering positions in the Marcellus and Utica Shale Asset Teams within reservoir, primarily focused on strategic joint ventures, divestitures, acquisitions and resource development planning. Mr. Rucker graduated with a Bachelor of Science degree in Petroleum Engineering from Marietta College, where he continues to serve on the Marietta College Industry Advisory Council. He is a member of the Society of Petroleum Engineers. |

|

|

2023 PROXY STATEMENT 21 |

|

EXECUTIVE OFFICERS |

|

NAME |

POSITIONS AND EXPERIENCE |

|

Michael Sluiter |

Senior Vice President, Reservoir Engineer since December 2018 Mr. Sluiter joined Gulfport from Noble Energy, Inc., where he held various engineering positions from January 2012 to November 2018, including, most recently, as the Permian Basin Business Unit Manager. Mr. Sluiter has over 18 years of experience in unconventional resource development, reservoir engineering, subsurface development, business development and acquisitions, as well as leadership skills, which he developed at Noble Energy, Santos Australia and Santos USA. Mr. Sluiter began his career as a wireline field services engineer for Schlumberger in Thailand. Mr. Sluiter received a Bachelor of Science degree in Chemical Engineering from the University of Sydney, Australia. |

|

Lester Zitkus Age: 57 |

Senior Vice President, Land since January 2017 Mr. Zitkus joined Gulfport as Vice President of Land in March 2014. Prior to joining the Company, Mr. Zitkus served as an independent consultant from October 2013 to March 2014 and as Vice President of Land for Chesapeake Energy Corporation from May 2007 to October 2013. During his 20-year tenure with Equitable Resources Inc. (now EQT Corp.), he held various positions, including Vice President of Operations and Senior Vice President of Land, between 1987 and 2007. He holds a degree in Mineral Land Management from the University of Evansville. Mr. Zitkus is a member of the American Association of Professional Landmen and Past Regional Director of the Independent Petroleum Association of America. |

|

22 2023 PROXY STATEMENT |

|

|

Letter from the Compensation Committee Chair |

2022 was an important turning point for Gulfport Energy. Once the restructuring process was successfully completed, a new Board of Directors was in place and key senior management team members were appointed, the Company was positioned to transition to a contemporary, best-in-class natural gas provider. Throughout the year, external factors such as high inflation and ongoing sourcing and logistical issues presented new challenges. The Company was able to effectively manage those issues while delivering solid operational results, which our shareholders expect.

From an executive compensation perspective, we were able to set realistic, challenging targets for our short and long-term incentive plans. We were pleased to see the financial and operational results exceeded our expectations. We were able to deliver on our strategy of providing compensation opportunities that were tied to Company performance. Our philosophy is to remain competitive within the oil and gas industry for similarly situated operations.

Please review the Compensation Discussion and Analysis, where we explain how we tie pay and performance to reward our executives. We are confident our shareholders will once again agree with the compensation decisions we made regarding our executive team as they did overwhelmingly based on the 99.7% of votes we received on our 2022 Say-On-Pay vote.

Thank you for your confidence and investment in Gulfport Energy.

Respectfully submitted by the Compensation Committee,

Jason Martinez, Chair

Guillermo (Bill) Martinez

David Reganato

David Wolf

Dated: April 10, 2023

|

|

2023 PROXY STATEMENT 23 |

|

COMPENSATION DISCUSSION AND ANALYSIS |

This Compensation Discussion and Analysis, or CD&A, explains the Compensation Committee’s compensation philosophy, summarizes our executive compensation programs and describes compensation decisions for Gulfport’s Chief Executive Officer, or CEO, Chief Financial Officer, or CFO, and the next three highest paid executive officers for 2022. These executive officers, known as our NEOs, are as follows:

|

Timothy Cutt |

Chief Executive Officer and Chairman of the Board |

|

William Buese |

Executive Vice President, Chief Financial Officer |

|

Patrick Craine |

Chief Legal and Administrative Officer and Corporate Secretary |

|

Michael Sluiter |

Senior Vice President of Reservoir Engineering |

|

Lester Zitkus |

Senior Vice President of Land |

|

24 2023 PROXY STATEMENT |

|

|

Gulfport 2022 Business Performance Highlights |

During 2022, we had the following notable achievements:

Financial

• Increased the borrowing base under the revolving credit facility from $850 million to $1.0 billion;

• Reduced total debt by $19 million;

• Generated significant adjusted free cash flow and utilized it to repurchase 2.9 million shares of common stock for $250.8 million during 2022;

• Expanded common stock repurchase program; and

• Reported year-end estimated net proved reserves of 4.0 Tcfe and total discounted future net cash flows of $8.3 billion.

Health, Safety & Environmental

• Reduced our total recordable incident rate and number of agency reportable spills year-over-year;

• Continued to improve our Contractor Management processes by performing safety audits for new contractors, refreshing safety audits for existing contractors and developing a new contractor orientation video;

• Advanced our WORK SAFE Program using visual aids in the field and ensuring contractor training requirements have been met;

• Created and delivered WORK GREEN Program training on the three focus areas – air, land, and water – to reinforce our environmental procedures, and policies; and

• Performed a gap assessment on our methane emissions management processes to initiate a gas certification project in Ohio.

Corporate Social Responsibility

• Completed a multi-year pledge to support Dolly Parton’s Imagination Library in Ohio to provide books to more than 3,750 children in Belmont, Jefferson and Monroe Counties; and

• Completed an environmental volunteer effort in Oklahoma, removing trash from the North Canadian River to continue the focus on our WORK GREEN program.

|

|

2023 PROXY STATEMENT 25 |

|

EXECUTIVE SUMMARY |

|

Key 2022 Executive Compensation Actions |

In consideration of our long-term strategy and stockholder feedback following a robust program of engagement (see “Stockholder Engagement and Annual Say-on-Pay Advisory Vote” below), the Company took the following actions in 2022:

• Provided an equity grant to the Chief Executive Officer and Chief Financial Officer who joined the Company in 2021 to provide a competitive package that is commensurate with the competitive market. No grants were made to our other NEOs in 2022 as the grants made during 2021 were intended to cover a multi-year period.

• Continued to use absolute and relative TSR and time-based vesting in equity plan grants to maximize the link between performance-based pay of our executives and shareholder value over time.

• Established annual performance bonus opportunities and long-term equity award targets to closely align our NEOs’ financial interests with those of our stockholders and to continue to link a larger portion of NEOs’ compensation to the performance of our stock and operational performance.

• Selected metrics in our annual incentive plan to include financial metrics directly tied to the financial health of the Company and specific and quantifiable health, safety and environmental metrics.

• Continued to provide robust disclosure of our performance metrics and targets for both performance-based cash and equity awards.

• Utilized formal stock ownership guidelines to ensure our Board of Directors and executive officers own a stake in the Company that is sufficient to align their interests with their fellow stockholders.

|

26 2023 PROXY STATEMENT |

|

|

EXECUTIVE SUMMARY |

The Compensation Committee will continue to consider the feedback from our stockholders when making compensation decisions for our NEOs.

|

Practices We Follow |

|

|

🗸 |

Incentives Aligned with Stockholders. All long-term equity incentive awards granted in 2022 were in the form of either time-based or performance-based restricted stock units, and the performance-based restricted stock units vest based on absolute and relative TSR metrics tied to share price, providing strong alignment between management and stockholders. |

|

🗸 |

NEO pay is at-risk. A significant portion of executive compensation is conditioned on achievement of pre-determined operational, capital efficiency and safety and environmental targets, as well as absolute TSR and relative TSR metrics measured against a broad peer group. |

|

🗸 |

Performance-based awards are prevalent. 60% of the NEOs’ equity incentive awards consisted of performance-based equity awards that vest based on absolute and relative TSR metrics measured over a three-year performance period. |

|

🗸 |

Robust disclosure of our performance metrics and targets. We provide detailed disclosure of our performance metrics in our CD&A. |

|

🗸 |

Balanced approach to executive compensation. We view the combination of long-term equity and short-term cash compensation, prioritizing long-term equity compensation and focusing on performance-based equity and cash compensation when analyzing total compensation plans. |

|

🗸 |

Ownership guidelines. We have robust stock-ownership guidelines for directors and executive officers. |

|

🗸 |

Risk Management. We perform annual enterprise risk assessments to ensure our use of incentive metrics doesn’t add undue risk to the business. |

|

🗸 |

Clawback and recoupment processes. We maintain a clawback policy that allows us to recover incentive compensation in certain circumstances. |

|

🗸 |

Executive Compensation best practices. The Compensation Committee uses an independent compensation consulting firm to provide input into our executive compensation programs. |

|

Practices We Prohibit |

|

|

û |

Minimum bonuses or guarantees. The Company does not guarantee minimum bonuses and relies on target achievement to determine annual bonus payments. |

|

û |

Single-trigger vesting of equity awards. The Company does not allow for single-trigger vesting of equity awards in connection with a change of control. |

|

û |

Providing tax gross-ups. No tax gross-up payments have been provided to our NEOs. |

|

û |

Hedging or pledging Gulfport Energy Stock. The Company does not allow hedging or pledging of Gulfport securities by our NEOs or directors. |

|

û |

Liberal share recycling. We do not allow liberal share recycling in our stock incentive plan. |

|

û |

Holding Gulfport Energy stock in a margin account. The Company does not allow securities to be held in a margin account by our NEOs or directors. |

|

û |

Excessive perquisites or executive benefits plans. No pension, supplemental executive retirement plan or excessive perquisite plans are made available to our NEOs. |

|

û |

Repricing of Stock Options. The Company did not grant stock options in 2022, currently has no plans to grant stock options in the future and would not reprice any outstanding stock options that might be outstanding. |

|

|

2023 PROXY STATEMENT 27 |

|

EXECUTIVE SUMMARY |

|

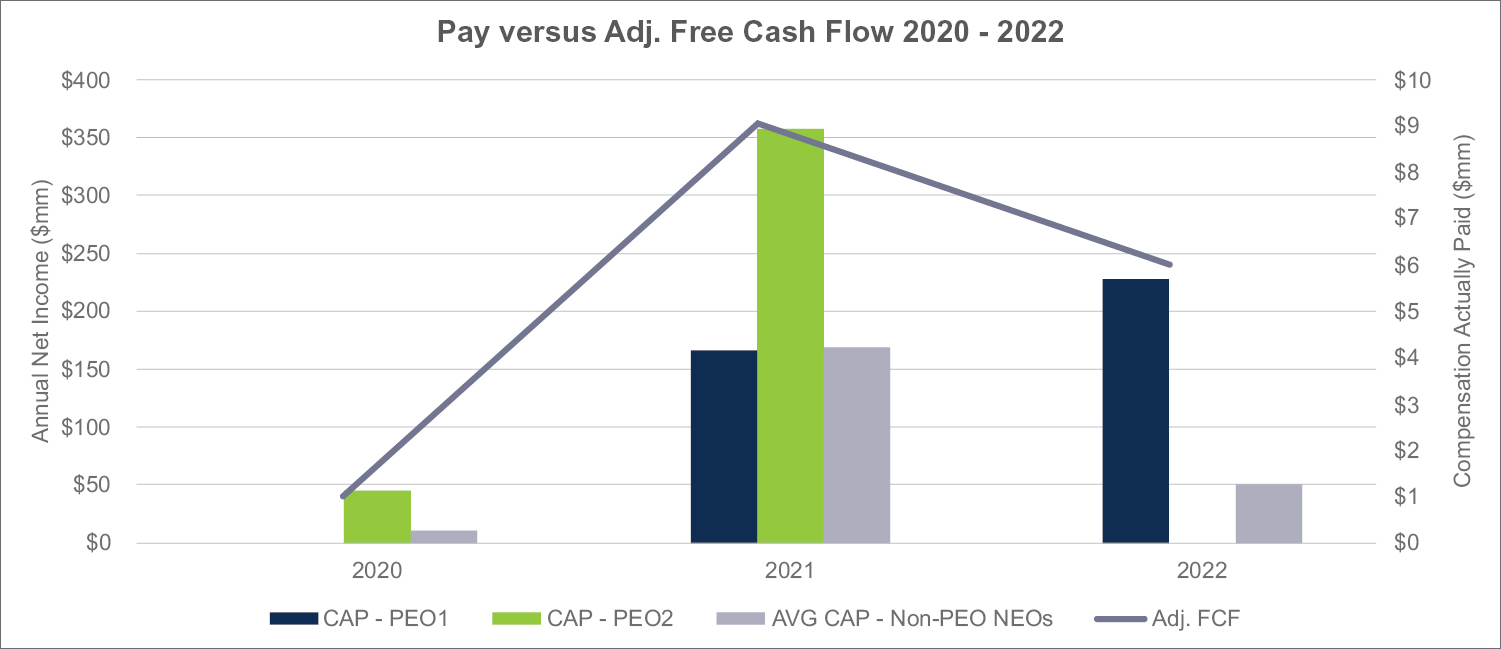

Compensation Aligned with Performance |

The Compensation Committee believes that executive compensation should be designed to deliver competitive pay when performance targets are achieved, and when business results exceed targets, executives should share in those rewards based on their efforts. If the Company does not achieve established performance goals, the executive team should receive pay that reflects that lower achievement. We believe this pay for performance alignment is working as realized pay for 2022 was above target levels due to exceeding pre-set, target-performance goals.

The majority of our current NEO’s total compensation is dependent on the successful achievement of Company results as measured by either short-term incentive plan metric achievement or achievement of performance measures and stock price appreciation of the Company’s common stock. The target total direct compensation of our NEOs is largely influenced by pay-at-risk or variable compensation, tying the pay of the executive to the Company’s performance and share price of the Company’s common stock. Short-term incentive plan targets for 2022 were exceeded, resulting in actual awards to executives that were higher than target amounts and demonstrating the alignment between performance and pay.

|

Stockholder Engagement and Annual Say-On-Pay Advisory Vote |

The Compensation Committee is committed to engaging with our stockholders and learning their expectations for executive compensation, corporate governance and safety, environmental and other social responsibility matters at Gulfport Energy. In 2022, 99.7% of shareholders voted to approve the Company’s executive compensation program and practices. The Company is pleased that shareholders continue to strongly support our executive pay program and remains committed to meeting with stockholders to solicit feedback on our executive compensation practices in the future. For information regarding this year’s advisory, non-binding vote on the frequency of future shareholder advisory votes regarding compensation paid to the Company’s named executive officers, see Proposal 4.

The Company held discussions with stockholders representing approximately 75% of shares outstanding. Through these conversations, our stockholders emphasized their expectation that management should be focused on driving results that deliver stockholder value. Our stockholders agree that executives should not be paid at target levels unless financial targets are achieved and expressed a desire to see specific and measurable targets for the year. Stockholders also expressed a desire for executives to have exposure to the absolute return of the Company’s common stock without regard to broader market fluctuation. The Company is confident that the metrics selected for both short-term and long-term incentives are appropriate and continue to align with shareholder preferences. Changes were made to metrics selected in the annual incentive plan to incorporate environmental, safety and other social practices for 2022.

After carefully considering input from stockholders, the Company took the following actions in 2022:

• Granted performance-based equity awards in the form of performance-based restricted stock units tied to absolute and relative TSR, vesting over a three-year performance period, comprising at least 60% of all the equity awards granted to our Chief Executive Officer and Chief Financial Officer in April 2022. No grants were made to our other NEOs in 2022 as the grants made during 2021 were intended to cover a multi-year period;

• Established short-term incentive opportunities and long-term equity award targets that closely align our NEOs’ financial interests with those of our stockholders and continue linking a larger portion of NEOs’ compensation to our operational and share price performance;

• Provided robust disclosure of our performance metrics and targets for both performance-based cash and equity awards; and