false000087449912/312021Q1P1Y00008744992021-01-012021-03-31xbrli:shares00008744992021-04-30iso4217:USD00008744992021-03-3100008744992020-12-31iso4217:USDxbrli:sharesxbrli:pure00008744992020-01-012020-12-310000874499us-gaap:NaturalGasProductionMember2021-01-012021-03-310000874499us-gaap:NaturalGasProductionMember2020-01-012020-03-310000874499us-gaap:OilAndCondensateMember2021-01-012021-03-310000874499us-gaap:OilAndCondensateMember2020-01-012020-03-310000874499gpor:NaturalgasliquidsalesMember2021-01-012021-03-310000874499gpor:NaturalgasliquidsalesMember2020-01-012020-03-3100008744992020-01-012020-03-310000874499us-gaap:CommonStockMember2020-12-310000874499us-gaap:AdditionalPaidInCapitalMember2020-12-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000874499us-gaap:RetainedEarningsMember2020-12-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310000874499us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000874499us-gaap:CommonStockMember2021-01-012021-03-310000874499us-gaap:CommonStockMember2021-03-310000874499us-gaap:AdditionalPaidInCapitalMember2021-03-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000874499us-gaap:RetainedEarningsMember2021-03-310000874499us-gaap:CommonStockMember2019-12-310000874499us-gaap:AdditionalPaidInCapitalMember2019-12-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000874499us-gaap:RetainedEarningsMember2019-12-3100008744992019-12-310000874499us-gaap:RetainedEarningsMember2020-01-012020-03-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000874499us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310000874499us-gaap:CommonStockMember2020-01-012020-03-310000874499us-gaap:CommonStockMember2020-03-310000874499us-gaap:AdditionalPaidInCapitalMember2020-03-310000874499us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000874499us-gaap:RetainedEarningsMember2020-03-3100008744992020-03-310000874499srt:ScenarioPreviouslyReportedMemberus-gaap:NaturalGasProductionMember2020-01-012020-03-310000874499srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMemberus-gaap:NaturalGasProductionMember2020-01-012020-03-310000874499srt:ScenarioPreviouslyReportedMember2020-01-012020-03-310000874499srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2020-01-012020-03-3100008744992020-11-130000874499gpor:A6.625SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310000874499gpor:A6.000SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310000874499us-gaap:SeniorNotesMembergpor:A6.375SeniorNotesDue2025Member2021-03-310000874499us-gaap:SeniorNotesMembergpor:A6.375SeniorNotesDue2026Member2021-03-310000874499us-gaap:SubsequentEventMembergpor:ExitFacilityMember2021-04-280000874499us-gaap:SubsequentEventMember2021-04-282021-04-280000874499us-gaap:SubsequentEventMembersrt:MaximumMember2021-04-28gpor:claim0000874499us-gaap:SubsequentEventMember2021-04-302021-04-300000874499us-gaap:SubsequentEventMember2021-04-300000874499gpor:UticaPropertiesMember2021-03-310000874499gpor:SCOOPMember2021-03-310000874499gpor:OtherNonProducingPropertiesMember2021-03-310000874499gpor:GrizzlyOilSandsUlcMember2021-03-310000874499gpor:GrizzlyOilSandsUlcMember2020-12-310000874499gpor:GrizzlyOilSandsUlcMember2021-01-012021-03-310000874499gpor:GrizzlyOilSandsUlcMember2020-01-012020-03-310000874499gpor:MammothEnergyServicesLPMember2021-03-310000874499gpor:MammothEnergyServicesLPMember2020-12-310000874499gpor:MammothEnergyServicesLPMember2021-01-012021-03-310000874499gpor:MammothEnergyServicesLPMember2020-01-012020-03-310000874499us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-03-310000874499us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-12-310000874499us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2021-01-012021-03-310000874499us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2020-01-012020-03-31utr:acre0000874499gpor:AthabascaPeaceRiverAndColdLakeOilSandsRegionsMembergpor:GrizzlyOilSandsUlcMember2021-01-012021-03-310000874499gpor:MammothEnergyServicesLPMember2020-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMember2021-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-310000874499us-gaap:LineOfCreditMembergpor:AmendedAndRestatedCreditAgreementMember2021-03-310000874499us-gaap:LineOfCreditMembergpor:AmendedAndRestatedCreditAgreementMember2020-12-310000874499gpor:A6.625SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310000874499gpor:A6.000SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310000874499gpor:A6.375SeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310000874499gpor:A6.375SeniorNotesMemberus-gaap:SeniorNotesMember2020-12-310000874499us-gaap:SeniorNotesMembergpor:A6.375SeniorNotesDue2026Member2020-12-310000874499gpor:BuildingLoanMember2021-03-310000874499gpor:BuildingLoanMember2020-12-310000874499gpor:DIPCreditFacilityMemberus-gaap:LetterOfCreditMember2021-03-31gpor:day0000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:EurodollarMember2021-01-012021-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2021-01-012021-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMember2021-01-012021-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-03-310000874499gpor:DIPCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2021-01-012021-03-310000874499us-gaap:RevolvingCreditFacilityMembergpor:AmendedAndRestatedCreditAgreementMember2019-12-310000874499us-gaap:RevolvingCreditFacilityMembergpor:AmendedAndRestatedCreditAgreementMember2020-10-080000874499us-gaap:LineOfCreditMembergpor:NovaScotiaAmegyKeybankMembergpor:AmendedAndRestatedCreditAgreementMember2021-03-310000874499us-gaap:RevolvingCreditFacilityMembergpor:AmendedAndRestatedCreditAgreementMember2021-01-012021-03-310000874499gpor:NovaScotiaAmegyKeybankMemberus-gaap:LetterOfCreditMembergpor:AmendedAndRestatedCreditAgreementMember2021-01-012021-03-310000874499us-gaap:PrepaidExpensesAndOtherCurrentAssetsMembergpor:NovaScotiaAmegyKeybankMemberus-gaap:LetterOfCreditMembergpor:AmendedAndRestatedCreditAgreementMember2021-03-310000874499gpor:NovaScotiaAmegyKeybankMemberus-gaap:LetterOfCreditMembergpor:AmendedAndRestatedCreditAgreementMember2021-03-310000874499us-gaap:LineOfCreditMembergpor:NovaScotiaAmegyKeybankMembergpor:AmendedAndRestatedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-03-310000874499us-gaap:OilAndGasPropertiesMember2021-01-012021-03-310000874499us-gaap:OilAndGasPropertiesMember2020-01-012020-03-310000874499us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2021-03-310000874499us-gaap:FairValueInputsLevel1Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310000874499us-gaap:RestrictedStockMember2020-12-310000874499us-gaap:PerformanceSharesMember2020-12-310000874499us-gaap:RestrictedStockMember2021-01-012021-03-310000874499us-gaap:PerformanceSharesMember2021-01-012021-03-310000874499us-gaap:RestrictedStockMember2021-03-310000874499us-gaap:PerformanceSharesMember2021-03-310000874499us-gaap:RestrictedStockMemberus-gaap:ShareBasedPaymentArrangementNonemployeeMembersrt:MinimumMember2021-01-012021-03-310000874499srt:MaximumMemberus-gaap:RestrictedStockMemberus-gaap:ShareBasedPaymentArrangementEmployeeMember2021-01-012021-03-310000874499gpor:IncentiveAwardsMember2020-08-042020-08-040000874499gpor:IncentiveAwardsMember2020-08-310000874499gpor:IncentiveAwardsMember2021-03-310000874499gpor:TransportationCommitmentMember2021-03-31utr:MMBTU0000874499gpor:StingrayPressurePumpingLLCVGulfportEnergyCorporationMember2021-01-012021-03-3100008744992020-04-012020-04-300000874499gpor:MuskieVGulfportEnergyCorporationMember2021-01-012021-03-310000874499gpor:TCEnergyCorporationAndRoverPipelineLLCVGulfportEnergyCorporationMember2021-01-012021-03-310000874499gpor:NYMEXHenryHubRemaining2021Member2021-01-012021-03-31iso4217:USDutr:MMBTU0000874499gpor:NYMEXHenryHubRemaining2021Member2021-03-31utr:bbl0000874499gpor:NYMEXWTIRemaining2021Member2021-01-012021-03-31iso4217:USDutr:bbl0000874499gpor:NYMEXWTIRemaining2021Member2021-03-310000874499gpor:MontBelvieuC3Remaining2021Member2021-01-012021-03-310000874499gpor:MontBelvieuC3Remaining2021Member2021-03-310000874499gpor:MontBelvieuC32022Member2021-01-012021-03-310000874499gpor:MontBelvieuC32022Member2021-03-310000874499gpor:NYMEXMember2019-12-310000874499us-gaap:CallOptionMemberus-gaap:ShortMembergpor:NYMEXHenryHub2022Member2021-01-012021-03-310000874499us-gaap:CallOptionMemberus-gaap:ShortMembergpor:NYMEXHenryHub2022Member2021-03-310000874499gpor:NYMEXHenryHub2023Memberus-gaap:CallOptionMemberus-gaap:ShortMember2021-01-012021-03-310000874499gpor:NYMEXHenryHub2023Memberus-gaap:CallOptionMemberus-gaap:ShortMember2021-03-310000874499gpor:NYMEXHenryHubRemaining2021Index1Member2021-01-012021-03-310000874499gpor:NYMEXHenryHubRemaining2021Index1Member2021-03-310000874499gpor:NYMEXHenryHub2022Index2Member2021-01-012021-03-310000874499gpor:NYMEXHenryHub2022Index2Member2021-03-310000874499gpor:BasisSwapRexZone3Remaining2021Member2021-01-012021-03-310000874499gpor:BasisSwapRexZone3Remaining2021Member2021-03-310000874499gpor:BasisSwapTetcoM2Remaining2021Member2021-01-012021-03-310000874499gpor:BasisSwapTetcoM2Remaining2021Member2021-03-310000874499gpor:BasisSwapRexZone32022Member2021-01-012021-03-310000874499gpor:BasisSwapRexZone32022Member2021-03-310000874499gpor:CommodityDerivativeInstrumentsMember2021-03-310000874499gpor:CommodityDerivativeInstrumentsMember2020-12-310000874499gpor:GasMember2021-01-012021-03-310000874499gpor:GasMember2020-01-012020-03-310000874499srt:OilReservesMember2021-01-012021-03-310000874499srt:OilReservesMember2020-01-012020-03-310000874499srt:NaturalGasReservesMember2021-01-012021-03-310000874499srt:NaturalGasReservesMember2020-01-012020-03-310000874499gpor:ContingentLAConsiderationMember2021-01-012021-03-310000874499gpor:ContingentLAConsiderationMember2020-01-012020-03-310000874499us-gaap:FairValueInputsLevel1Member2021-03-310000874499us-gaap:FairValueInputsLevel2Member2021-03-310000874499us-gaap:FairValueInputsLevel3Member2021-03-310000874499us-gaap:FairValueInputsLevel1Member2020-12-310000874499us-gaap:FairValueInputsLevel2Member2020-12-310000874499us-gaap:FairValueInputsLevel3Member2020-12-310000874499us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-03-310000874499us-gaap:OtherNoncurrentAssetsMember2021-03-310000874499us-gaap:FairValueInputsLevel3Member2021-01-012021-03-310000874499srt:MaximumMember2021-01-012021-03-310000874499srt:MinimumMembergpor:DrillingRigCommitmentsMember2021-03-310000874499srt:MaximumMembergpor:DrillingRigCommitmentsMember2021-03-310000874499srt:MinimumMember2021-03-310000874499srt:MaximumMember2021-03-310000874499us-gaap:SubsequentEventMembersrt:MinimumMember2021-04-282021-04-280000874499us-gaap:SubsequentEventMembersrt:MaximumMember2021-04-282021-04-280000874499us-gaap:SubsequentEventMembergpor:BasisSwapRexZone32022Member2021-04-012021-04-300000874499us-gaap:SubsequentEventMembergpor:BasisSwapRexZone32022Member2021-04-300000874499us-gaap:SubsequentEventMembergpor:NYMEXHenryHub2022Index1Member2021-04-012021-04-300000874499us-gaap:SubsequentEventMembersrt:MinimumMembergpor:NYMEXHenryHub2022Index1Member2021-04-300000874499us-gaap:SubsequentEventMembersrt:MaximumMembergpor:NYMEXHenryHub2022Index1Member2021-04-300000874499us-gaap:SubsequentEventMembergpor:NYMEXHenryHub2022Index2Member2021-04-012021-04-300000874499us-gaap:SubsequentEventMembersrt:MinimumMembergpor:NYMEXHenryHub2022Index2Member2021-04-300000874499us-gaap:SubsequentEventMembersrt:MaximumMembergpor:NYMEXHenryHub2022Index2Member2021-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | | | | |

| ☒ | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

|

For the quarterly period ended March 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from to

Commission File Number 001-19514

Gulfport Energy Corporation

(Exact Name of Registrant As Specified in Its Charter)

| | | | | | | | |

| Delaware | 73-1521290 |

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification Number) |

| 3001 Quail Springs Parkway | |

| Oklahoma City, | Oklahoma | 73134 |

| (Address of Principal Executive Offices) | (Zip Code) |

(405) 252-4600

(Registrant Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None(1)

(1) On November 27, 2020, our common stock was suspended from trading on the NASDAQ Stock Market LLC ("NASDAQ"). On November 30, 2020, our common stock began trading on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc. under the symbol “GPORQ". On February 2, 2021, NASDAQ filed a Form 25 delisting our common stock from trading on NASDAQ, which delisting became effective 10 days after the filing of the Form 25. In accordance with Rule 12d2-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the de-registration of our common stock under section 12(b) of the Exchange Act became effective on February 12, 2021.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock

(Title of Class)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer ¨ Accelerated filer ý Non-accelerated filer ¨

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

As of April 30, 2021, 160,892,447 shares of the registrant’s common stock were outstanding.

GULFPORT ENERGY CORPORATION

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

|

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

|

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| | |

DEFINITIONS

| | |

| Unless the context otherwise indicates, references to “us,” “we,” “our,” “ours,” “Gulfport,” the “Company” and “Registrant” refer to Gulfport Energy Corporation and its consolidated subsidiaries. All monetary values, other than per unit and per share amounts, are stated in thousands of U.S. dollars unless otherwise specified. In addition, the following are other abbreviations and definitions of certain terms used within this Quarterly Report on Form 10-Q: |

|

|

|

|

|

2023 Notes. 6.625% Senior Notes due 2023. |

2024 Notes. 6.000% Senior Notes due 2024. |

2025 Notes. 6.375% Senior Notes due 2025. |

2026 Notes. 6.375% Senior Notes due 2026. |

ASC. Accounting Standards Codification. |

ASU. Accounting Standards Update. |

Bankruptcy Code. Chapter 11 of Title 11 of the United States Code. |

Bankruptcy Court. The United States Bankruptcy Court for the Southern District of Texas. |

|

Bbl. One stock tank barrel, or 42 U.S. gallons liquid volume, used herein in reference to crude oil or other liquid hydrocarbons. |

|

|

Btu. British thermal unit, which represents the amount of energy needed to heat one pound of water by one degree Fahrenheit and can be used to describe the energy content of fuels. |

Building Loan. Loan agreement for our corporate headquarters scheduled to mature in June 2025. |

Chapter 11 Cases. Voluntary petitions filed on November 13, 2020 by Gulfport Energy Corporation, Gator Marine, Inc., Gator Marine Ivanhoe, Inc., Grizzly Holdings, Inc., Gulfport Appalachia, LLC, Gulfport Midcon, LLC, Gulfport Midstream Holdings, LLC, Jaguar Resources LLC, Mule Sky LLC, Puma Resources, Inc. and Westhawk Minerals LLC. |

Completion. The process of treating a drilled well followed by the installation of permanent equipment for the production of natural gas, oil and NGL. |

|

DD&A. Depreciation, depletion and amortization. |

Debtors. Collectively, Gulfport Energy Corporation, Gator Marine, Inc., Gator Marine Ivanhoe, Inc., Grizzly Holdings, Inc., Gulfport Appalachia, LLC, Gulfport Midcon, LLC, Gulfport Midstream Holdings, LLC, Jaguar Resources LLC, Mule Sky LLC, Puma Resources, Inc. and Westhawk Minerals LLC. |

|

|

DIP Credit Facility. Senior secured superpriority debtor-in-possession revolving credit facility in an aggregate principal amount of $262.5 million. |

|

|

Grizzly. Grizzly Oil Sands ULC. |

Grizzly Holdings. Grizzly Holdings Inc. |

Gross Acres or Gross Wells. Refers to the total acres or wells in which a working interest is owned. |

Guarantors. All existing consolidated subsidiaries that guarantee the Company's revolving credit facility or certain other debt. |

|

|

LIBOR. London Interbank Offered Rate. |

LOE. Lease operating expenses. |

MBbl. One thousand barrels of crude oil, condensate or natural gas liquids. |

Mcf. One thousand cubic feet of natural gas. |

Mcfe. One thousand cubic feet of natural gas equivalent. |

|

MMBtu. One million British thermal units. |

MMcf. One million cubic feet of natural gas. |

MMcfe. One million cubic feet of natural gas equivalent. |

Natural Gas Liquids (NGL). Hydrocarbons in natural gas that are separated from the gas as liquids through the process of absorption, condensation, adsorption or other methods in gas processing or cycling plants. Natural gas liquids primarily include ethane, propane, butane, isobutene, pentane, hexane and natural gasoline. |

Net Acres or Net Wells. Refers to the sum of the fractional working interests owned in gross acres or gross wells. |

|

NYMEX. New York Mercantile Exchange. |

|

Petition Date. November 13, 2020. |

Plan. The Amended Joint Chapter 11 Plan of Reorganization of Gulfport Energy Corporation and Its Debtor Subsidiaries. |

| | |

Pre-Petition Revolving Credit Facility. Senior secured revolving credit facility, as amended, with The Bank of Nova Scotia as the lead arranger and administrative agent and certain lenders from time to time party thereto with a maximum facility amount of $580 million. |

|

|

|

|

|

|

Restructuring. Restructuring contemplated under the Restructuring Support Agreement including equitizing a significant portion of our pre-petition indebtedness and rejecting or renegotiating certain contracts. |

|

RSA. Restructuring Support Agreement. |

SCOOP. Refers to the South Central Oklahoma Oil Province, a term used to describe a defined area that encompasses many of the top hydrocarbon producing counties in Oklahoma within the Anadarko basin. The SCOOP play mainly targets the Devonian to Mississippian aged Woodford, Sycamore and Springer formations. Our acreage is primarily in Garvin, Grady and Stephens Counties. |

SEC. The United States Securities and Exchange Commission. |

|

Senior Notes. Collectively, the 2023 Notes, 2024 Notes, 2025 Notes and 2026 Notes. |

|

|

Undeveloped Acreage. Lease or mineral acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of crude oil and/or natural gas. |

|

Utica. Refers to the hydrocarbon bearing rock formation located in the Appalachian Basin of the United States and Canada. Our acreage is located primarily in Belmont, Harrison, Jefferson and Monroe Counties in Eastern Ohio. |

Working Interest (WI). The operating interest which gives the owner the right to drill, produce and conduct operating activities on the property and a share of production. |

WTI. Refers to West Texas Intermediate. |

GULFPORT ENERGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(DEBTOR-IN-POSSESSION)

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (Unaudited) | | |

| (In thousands, except share data) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 179,701 | | | $ | 89,861 | |

| | | |

| | | |

| Accounts receivable—oil and natural gas sales | 133,996 | | | 119,879 | |

| Accounts receivable—joint interest and other | 12,904 | | | 12,200 | |

| | | |

| Prepaid expenses and other current assets | 134,509 | | | 160,664 | |

| Short-term derivative instruments | 12,422 | | | 27,146 | |

| Total current assets | 473,532 | | | 409,750 | |

| Property and equipment: | | | |

Oil and natural gas properties, full-cost accounting, $1,413,774 and $1,457,043 excluded from amortization in 2021 and 2020, respectively | 10,895,625 | | | 10,816,909 | |

| Other property and equipment | 88,835 | | | 88,538 | |

| Accumulated depletion, depreciation, amortization and impairment | (8,874,899) | | | (8,819,178) | |

| Property and equipment, net | 2,109,561 | | | 2,086,269 | |

| Other assets: | | | |

| Equity investments | 27,044 | | | 24,816 | |

| Long-term derivative instruments | 652 | | | 322 | |

| | | |

| | | |

| Operating lease assets | 314 | | | 342 | |

| | | |

| Other assets | 16,545 | | | 18,372 | |

| Total other assets | 44,555 | | | 43,852 | |

| Total assets | $ | 2,627,648 | | | $ | 2,539,871 | |

| Liabilities and Stockholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 310,172 | | | $ | 244,903 | |

| | | |

| Short-term derivative instruments | 20,687 | | | 11,641 | |

| | | |

| | | |

| Current maturities of long-term debt | 279,807 | | | 253,743 | |

| Total current liabilities | 610,666 | | | 510,287 | |

| Non-current liabilities: | | | |

| Long-term derivative instruments | 43,267 | | | 36,604 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total non-current liabilities | 43,267 | | | 36,604 | |

| Liabilities subject to compromise | 2,261,453 | | | 2,293,480 | |

| Total liabilities | $ | 2,915,386 | | | $ | 2,840,371 | |

Commitments and contingencies (Note 8) | | | |

Preferred stock - $0.01 par value; 5.0 million shares authorized (30 thousand authorized as redeemable 12% cumulative preferred stock, Series A), and none issued and outstanding | — | | | — | |

| Stockholders’ deficit: | | | |

Common stock - $0.01 par value, 200.0 million shares authorized, 160.9 million issued and outstanding at March 31, 2021 and 160.8 million at December 31, 2020 | 1,609 | | | 1,607 | |

| Paid-in capital | 4,215,162 | | | 4,213,752 | |

| Accumulated other comprehensive loss | (40,430) | | | (43,000) | |

| Accumulated deficit | (4,464,079) | | | (4,472,859) | |

| Total stockholders’ deficit | $ | (287,738) | | | $ | (300,500) | |

| Total liabilities and stockholders’ deficit | $ | 2,627,648 | | | $ | 2,539,871 | |

See accompanying notes to consolidated financial statements.

GULFPORT ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(DEBTOR-IN-POSSESSION)

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| 2021 | | 2020 | | | | |

| (In thousands) |

| REVENUES: | | | | | | | |

| Natural gas sales | $ | 235,321 | | | $ | 161,008 | | | | | |

| Oil and condensate sales | 18,239 | | | 23,151 | | | | | |

| Natural gas liquid sales | 23,776 | | | 16,913 | | | | | |

| Net (loss) gain on natural gas, oil and NGL derivatives | (29,978) | | | 98,266 | | | | | |

| Total Revenues | 247,358 | | | 299,338 | | | | | |

| OPERATING EXPENSES: | | | | | | | |

| Lease operating expenses | 12,653 | | | 14,695 | | | | | |

| Taxes other than income | 8,704 | | | 6,637 | | | | | |

| Transportation, gathering, processing and compression | 105,867 | | | 110,357 | | | | | |

| Depreciation, depletion and amortization | 41,147 | | | 78,028 | | | | | |

| Impairment of oil and natural gas properties | — | | | 553,345 | | | | | |

| Impairment of other property and equipment | 14,568 | | | — | | | | | |

| General and administrative expenses | 12,757 | | | 15,622 | | | | | |

| | | | | | | |

| Accretion expense | 805 | | | 741 | | | | | |

| | | | | | | |

| Total Operating Expenses | 196,501 | | | 779,425 | | | | | |

| INCOME (LOSS) FROM OPERATIONS | 50,857 | | | (480,087) | | | | | |

| OTHER EXPENSE (INCOME): | | | | | | | |

| Interest expense | 3,261 | | | 32,990 | | | | | |

| Interest income | (143) | | | (152) | | | | | |

| Gain on debt extinguishment | — | | | (15,322) | | | | | |

| | | | | | | |

| Loss from equity method investments, net | 342 | | | 10,789 | | | | | |

| Reorganization items, net | 38,721 | | | — | | | | | |

| Other expense | (104) | | | 1,856 | | | | | |

| Total Other Expense | 42,077 | | | 30,161 | | | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | 8,780 | | | (510,248) | | | | | |

| Income Tax Expense | — | | | 7,290 | | | | | |

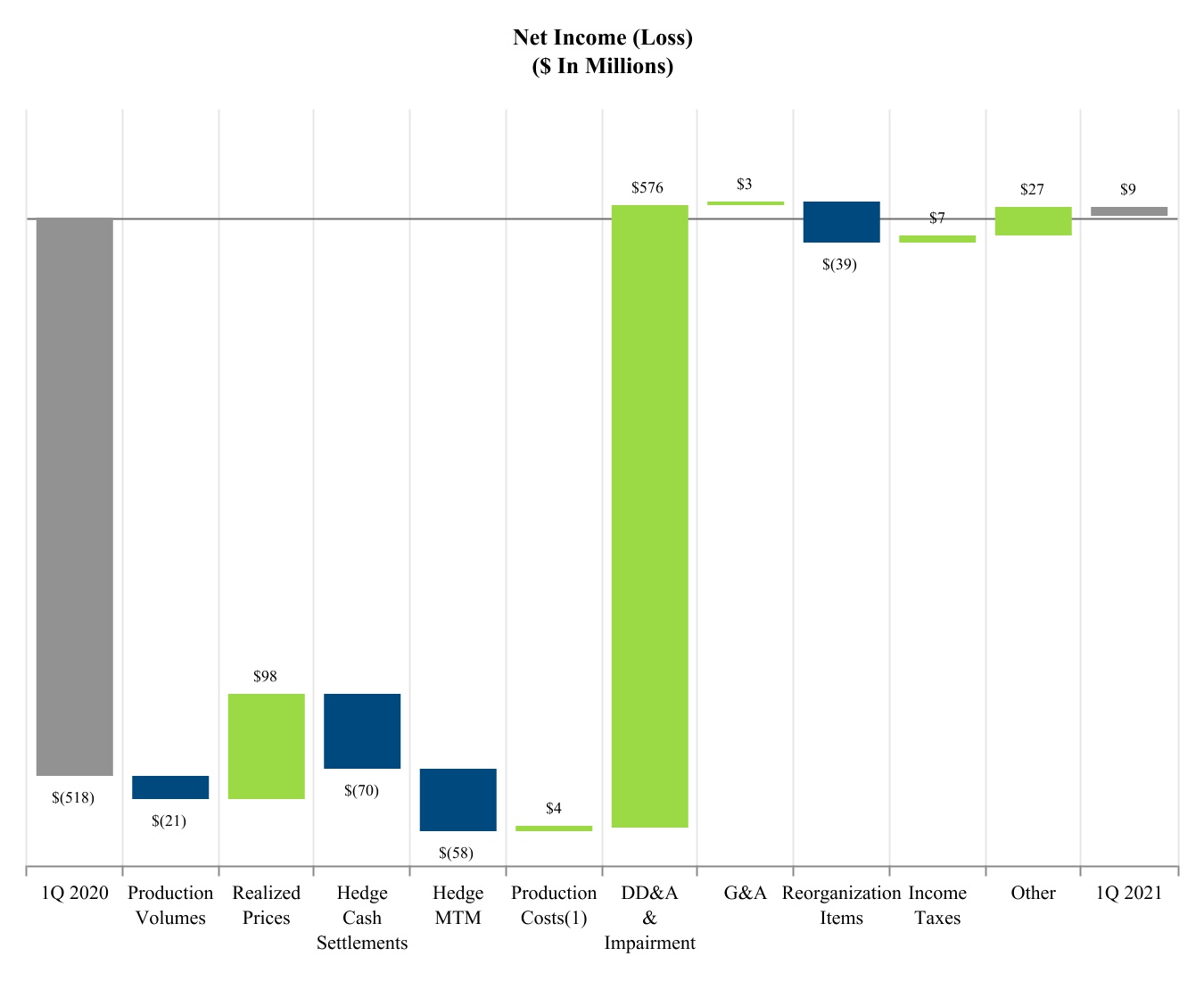

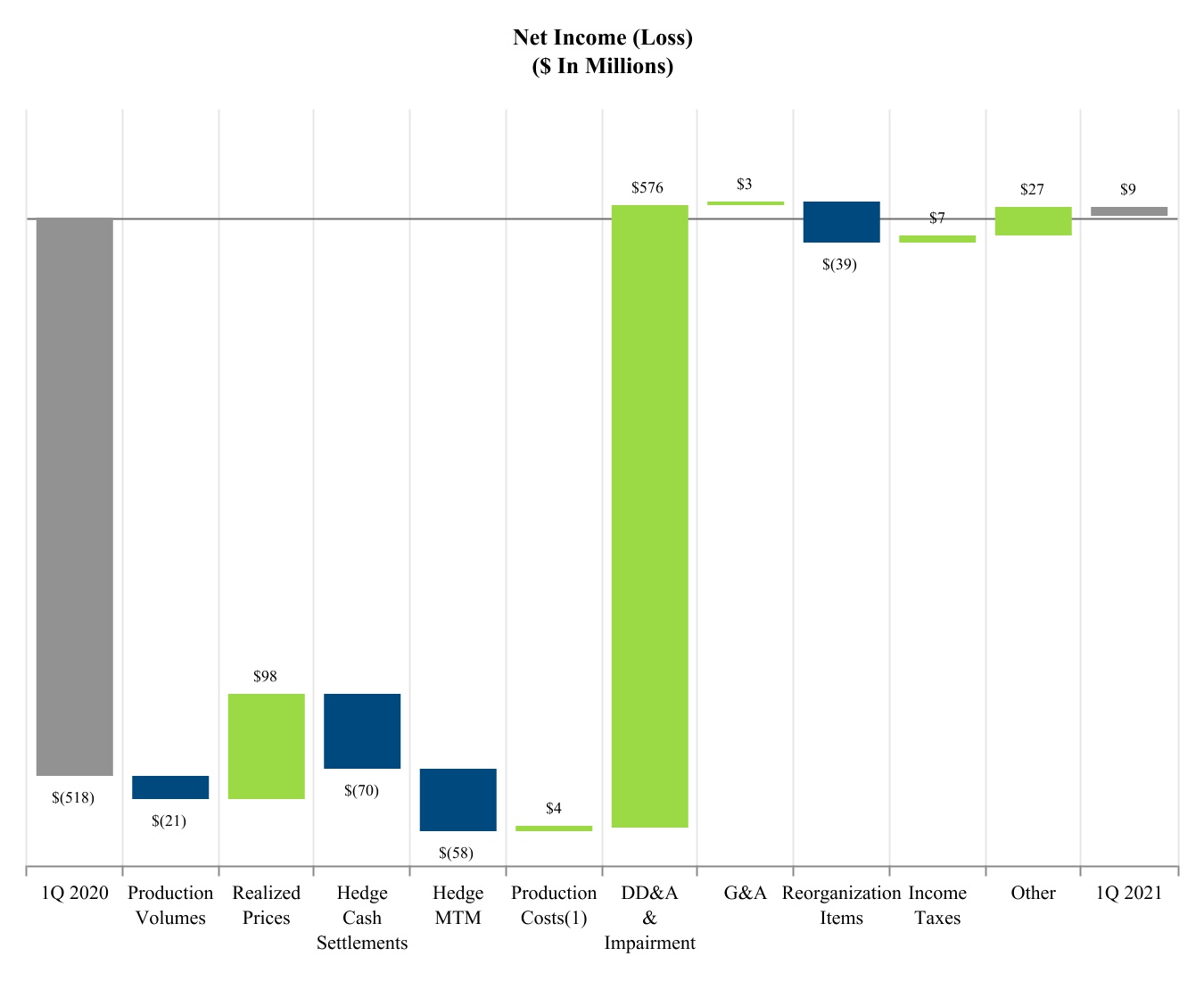

| NET INCOME (LOSS) | $ | 8,780 | | | $ | (517,538) | | | | | |

| NET INCOME (LOSS) PER COMMON SHARE: | | | | | | | |

| Basic | $ | 0.05 | | | $ | (3.24) | | | | | |

| Diluted | $ | 0.05 | | | $ | (3.24) | | | | | |

| Weighted average common shares outstanding—Basic | 160,813 | | | 159,760 | | | | | |

| Weighted average common shares outstanding—Diluted | 160,813 | | | 159,760 | | | | | |

See accompanying notes to consolidated financial statements.

GULFPORT ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(DEBTOR-IN-POSSESSION)

(Unaudited)

| | | | | | | | | | | | | | | |

| | Three months ended March 31, | | |

| 2021 | | 2020 | | | | |

| (In thousands) |

| Net income (loss) | $ | 8,780 | | | $ | (517,538) | | | | | |

| Foreign currency translation adjustment | 2,570 | | | (15,030) | | | | | |

| | | | | | | |

| Other comprehensive income (loss) | 2,570 | | | (15,030) | | | | | |

| Comprehensive income (loss) | $ | 11,350 | | | $ | (532,568) | | | | | |

See accompanying notes to consolidated financial statements.

GULFPORT ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ (DEFICIT) EQUITY

(DEBTOR-IN-POSSESSION)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Paid-in

Capital | | Accumulated Other

Comprehensive (Loss) Income | | Accumulated

Deficit | | Total Stockholders’

Deficit |

| Common Stock | | | | |

| | Shares | | Amount | | | | |

| (In thousands) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance at January 1, 2021 | 160,762 | | | $ | 1,607 | | | $ | 4,213,752 | | | $ | (43,000) | | | $ | (4,472,859) | | | $ | (300,500) | |

| Net Income | — | | | — | | | — | | | — | | | 8,780 | | | 8,780 | |

| Other Comprehensive Income | — | | | — | | | — | | | 2,570 | | | — | | | 2,570 | |

| Stock Compensation | — | | | — | | | 1,419 | | | — | | | — | | | 1,419 | |

| Shares Repurchased | (86) | | | (1) | | | (7) | | | — | | | — | | | (8) | |

| Issuance of Restricted Stock | 203 | | | 3 | | | (2) | | | — | | | — | | | 1 | |

| Balance at March 31, 2021 | 160,878 | | | $ | 1,609 | | | $ | 4,215,162 | | | $ | (40,430) | | | $ | (4,464,079) | | | $ | (287,738) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Paid-in

Capital | | Accumulated

Other

Comprehensive Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Common Stock | | | | |

| | Shares | | Amount | | | | |

| (In thousands) |

| Balance at January 1, 2020 | 159,711 | | | $ | 1,597 | | | $ | 4,207,554 | | | $ | (46,833) | | | $ | (2,847,726) | | | $ | 1,314,592 | |

| Net Loss | — | | | — | | | — | | | — | | | (517,538) | | | (517,538) | |

| Other Comprehensive Income | — | | | — | | | — | | | (15,030) | | | — | | | (15,030) | |

| Stock Compensation | — | | | — | | | 2,104 | | | — | | | — | | | 2,104 | |

| Shares Repurchased | (80) | | | (1) | | | (78) | | | — | | | — | | | (79) | |

| Issuance of Restricted Stock | 211 | | | 2 | | | (2) | | | — | | | — | | | — | |

| Balance at March 31, 2020 | 159,842 | | | $ | 1,598 | | | $ | 4,209,578 | | | $ | (61,863) | | | $ | (3,365,264) | | | $ | 784,049 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

GULFPORT ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(DEBTOR-IN-POSSESSION)

(Unaudited)

| | | | | | | | | | | |

| | Three months ended March 31, |

| 2021 | | 2020 |

| (In thousands) |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 8,780 | | | $ | (517,538) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depletion, depreciation and amortization | 41,147 | | | 78,028 | |

| Impairment of oil and natural gas properties | — | | | 553,345 | |

| Impairment of other property and equipment | 14,568 | | | — | |

| Loss from equity investments | 342 | | | 10,789 | |

| Gain on debt extinguishment | — | | | (15,322) | |

| Net loss (gain) on derivative instruments | 29,978 | | | (98,266) | |

| Net cash receipts on settled derivative instruments | 125 | | | 70,733 | |

| | | |

| Deferred income tax expense | — | | | 7,290 | |

| Other, net | 1,574 | | | 3,223 | |

| Changes in operating assets and liabilities, net | 26,661 | | | 38,556 | |

| Net cash provided by operating activities | 123,175 | | | 130,838 | |

| Cash flows from investing activities: | | | |

| Additions to oil and natural gas properties | (56,895) | | | (113,744) | |

| Proceeds from sale of oil and natural gas properties | 15 | | | 44,383 | |

| Other, net | (296) | | | (448) | |

| Net cash used in investing activities | (57,176) | | | (69,809) | |

| Cash flows from financing activities: | | | |

| Principal payments on pre-petition revolving credit facility | (2,202) | | | (180,000) | |

| Borrowings on pre-petition revolving credit facility | 26,050 | | | 125,000 | |

| | | |

| | | |

| Repurchase of senior notes | — | | | (10,204) | |

| | | |

| Other, net | (7) | | | (252) | |

| Net cash provided by (used in) financing activities | 23,841 | | | (65,456) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 89,840 | | | (4,427) | |

| Cash, cash equivalents and restricted cash at beginning of period | 89,861 | | | 6,060 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 179,701 | | | $ | 1,633 | |

See accompanying notes to consolidated financial statements.

GULFPORT ENERGY CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(DEBTOR-IN-POSSESSION)

(Unaudited)

1.BASIS OF PRESENTATION AND LIQUIDITY, MANAGEMENT'S PLANS AND GOING CONCERN

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared by Gulfport Energy Corporation (the “Company” or “Gulfport”) pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”), and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of the results for the interim periods reported in all material respects, on a basis consistent with the annual audited consolidated financial statements. All such adjustments are of a normal, recurring nature. Certain information, accounting policies, and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles ("GAAP") have been omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading.

The consolidated financial statements should be read in conjunction with the consolidated financial statements and the summary of significant accounting policies and notes included in the Company’s most recent annual report on Form 10-K. Results for the three months ended March 31, 2021 are not necessarily indicative of the results expected for the full year.

Voluntary Reorganization Under Chapter 11 of the Bankruptcy Code

On November 13, 2020, Gulfport Energy Corporation, Gator Marine, Inc., Gator Marine Ivanhoe, Inc., Grizzly Holdings, Inc., Gulfport Appalachia, LLC, Gulfport Midcon, LLC, Gulfport Midstream Holdings, LLC, Jaguar Resources LLC, Mule Sky LLC, Puma Resources, Inc. and Westhawk Minerals LLC filed voluntary petitions of relief under Chapter 11 of Title 11 of the United States Code in the United States Bankruptcy Court for the Southern District of Texas. The Chapter 11 Cases are being administered jointly under the caption In re Gulfport Energy Corporation, et al., Case No. 20-35562 (DRJ). The debtors continue to operate their businesses as "debtors-in-possession" under the jurisdiction of the Bankruptcy Court, in accordance with the applicable provisions of the Bankruptcy Code and the orders of the Bankruptcy Court.

The commencement of a voluntary proceeding in bankruptcy constituted an event of default that accelerated the Company's obligations under the Company's Pre-Petition Revolving Credit Facility and the indentures governing the Company's senior notes, resulting in the principal and interest due thereunder becoming immediately due and payable. Subject to certain specific exceptions under the Bankruptcy Code, the filing of the Chapter 11 Cases automatically stayed all judicial or administrative actions against the Company and efforts by creditors to collect on or otherwise exercise rights or remedies with respect to pre-petition claims. Absent an order from the Bankruptcy Court, substantially all of the Debtors’ pre-petition liabilities are subject to settlement under the Bankruptcy Code.

The Company has applied FASB ASC Topic 852 - Reorganizations ("ASC 852") in preparing the consolidated financial statements, which specifies the accounting and financial reporting requirements for entities reorganizing through Chapter 11 bankruptcy proceedings. These requirements include distinguishing transactions associated with the reorganization separate from activities related to the ongoing operations of the business. Accordingly, pre-petition liabilities that may be impacted by the Chapter 11 proceedings have been classified as liabilities subject to compromise on the consolidated balance sheets as of March 31, 2021 and December 31, 2020. Additionally, certain expenses, realized gains and losses and provisions for losses that are realized or incurred during the Chapter 11 Cases are recorded as reorganization items, net in the consolidated statements of operations for the three months ended March 31, 2021. Refer to Note 2 for more information on the events of the bankruptcy proceedings as well as the accounting and reporting impacts of the reorganization. Ability to Continue as a Going Concern

The accompanying unaudited consolidated financial statements are prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As discussed above, the filing of the Chapter 11 Cases constituted an event of default under the Company’s Pre-Petition Revolving Credit Facility and the indentures governing the Company's senior notes (the "Default"), resulting in the principal

and interest due thereunder becoming immediately due and payable. The Company does not have sufficient cash on hand or available liquidity to repay these amounts due. These conditions and events raise substantial doubt about the Company’s ability to continue as a going concern.

As part of the Chapter 11 Cases, the Company submitted the Plan to the Bankruptcy Court. The Company’s operations and its ability to develop and execute its business plan are subject to a high degree of risk and uncertainty associated with the Chapter 11 Cases. As discussed in Note 14, an order was entered by the Bankruptcy Court confirming the Company's Plan on April 28, 2021 and it expects to emerge from bankruptcy in May 2021. However, there can be no assurance that the Company will consummate the confirmed Plan, and as a result, the Company has concluded that management’s plans do not alleviate substantial doubt about the Company’s ability to continue as a going concern.

While operating as a debtor-in-possession, the Company may settle liabilities, subject to the approval of the Bankruptcy Court or as otherwise permitted in the ordinary course of business, for amounts other than those reflected in the accompanying consolidated financial statements. Further, the Plan or other bankruptcy proceedings could materially change the amounts and classifications of assets and liabilities reported in the consolidated financial statements, including liabilities subject to compromise which will be resolved in connection with the Chapter 11 Cases. The accompanying unaudited consolidated financial statements do not include any adjustments related to the recoverability and classification of assets or the amounts and classification of liabilities or any other adjustments that might be necessary should the Company be unable to continue as a going concern or as a consequence of the Chapter 11 Cases.

Impact on Previously Reported Results

During the third quarter of 2020, the Company identified that certain firm transportation costs incurred in prior periods were misclassified as deducts to "natural gas sales" while they should have been included in "transportation, gathering, processing and compression" on its consolidated statements of operations. The Company assessed the materiality of this presentation on prior periods’ consolidated financial statements in accordance with the SEC Staff Accounting Bulletin No. 99, “Materiality”, codified in ASC Topic 250, “Accounting Changes and Error Corrections”. Based on this assessment, the Company concluded that the correction is not material to any previously issued financial statements. The correction had no impact on its consolidated balance sheets, consolidated statements of comprehensive income, consolidated statements of stockholders' equity or consolidated statements of cash flows. Additionally, the error had no impact on net loss or net loss per share. The Company will conform presentation of previously reported consolidated statements of operations in future filings. The following tables present the effect of the correction on all affected line items of our previously issued consolidated financial statements of operations for the three months ended March 31, 2020.

| | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2020 |

| As Reported | | Adjustments | | As Revised |

| (In thousands) |

| Natural gas sales | $ | 108,547 | | | $ | 52,461 | | | $ | 161,008 | |

| Total Revenues | $ | 246,877 | | | $ | 52,461 | | | $ | 299,338 | |

| Transportation, gathering, processing and compression | $ | 57,896 | | | $ | 52,461 | | | $ | 110,357 | |

| Total Operating Expenses | $ | 726,964 | | | $ | 52,461 | | | $ | 779,425 | |

Supplemental Cash Flow and Non-Cash Information

| | | | | | | | | | | |

| Three months ended March 31, |

| 2021 | | 2020 |

| Supplemental disclosure of cash flow information: | (In thousands) |

| Cash paid for reorganization items, net | $ | 21,367 | | | $ | — | |

| Interest payments | $ | 4,763 | | | $ | 14,034 | |

| Changes in operating assets and liabilities: | | | |

| (Increase) decrease in accounts receivable - oil and natural gas sales | $ | (14,117) | | | $ | 47,111 | |

| (Increase) decrease in accounts receivable - joint interest and other | (478) | | | 6,001 | |

| Increase (decrease) in accounts payable and accrued liabilities | 15,555 | | | (7,637) | |

| (Increase) decrease in prepaid expenses | 26,356 | | | (6,920) | |

| (Increase) decrease in other assets | (655) | | | 1 | |

| Total changes in operating assets and liabilities | $ | 26,661 | | | $ | 38,556 | |

| Supplemental disclosure of non-cash transactions: | | | |

| Capitalized stock-based compensation | $ | 630 | | | $ | 934 | |

| Asset retirement obligation capitalized | $ | 483 | | | $ | 381 | |

| Asset retirement obligation removed due to divestiture | $ | — | | | $ | (2,033) | |

| Interest capitalized | $ | — | | | $ | 187 | |

| Fair value of contingent consideration asset on date of divestiture | $ | — | | | $ | 23,090 | |

| Foreign currency translation gain (loss) on equity method investments | $ | 2,570 | | | $ | (15,030) | |

2.CHAPTER 11 PROCEEDINGS

Restructuring Support Agreement

On November 13, 2020, the Debtors commenced the Chapter 11 Cases as described in Note 1 above. To ensure ordinary course operations, the Debtors have obtained approval from the Bankruptcy Court for certain first- and second-day motions, including motions to obtain customary relief intended to continue ordinary course operations after the Petition Date. In addition, the Debtors have received authority to use cash collateral of the lenders under the DIP Credit Facility.

On November 13, 2020, the Debtors entered into a restructuring support agreement with (i) over 95% of the lenders (the “Consenting RBL Lenders”) party to the Pre-Petition Revolving Credit Facility, dated as of December 27, 2013, by and among the Company, as borrower, each of the lenders party thereto, the Bank of Nova Scotia, as administrative agent and issuing bank, the joint lead arrangers and joint bookrunners, the co-syndication agents, and the co-documentation agents and (ii) certain holders (the “Consenting Noteholders,” and, together with the Consenting RBL Lenders, the “Consenting Stakeholders”) holding over two-thirds of the Company’s (a) 6.625% senior notes due 2023, issued under that certain Indenture, dated as of April 21, 2015, (b) 6.000% senior notes due 2024, issued under that certain Indenture, dated as of October 14, 2016, (c) 6.375% senior notes due 2025, issued under that certain Indenture, dated as of December 21, 2016, and (d) 6.375% senior notes due 2026, issued under that certain Indenture, dated as of October 11, 2017 (collectively, the “Unsecured Notes”), each by and among the Company, the subsidiary guarantors party thereto, and UMB Bank, N.A. as successor trustee.

The RSA outlines the key elements and actions the Company plans to take as part of Chapter 11 process, including equitizing a significant portion of its prepetition indebtedness and rejecting or renegotiating certain contracts which will result in a materially improved balance sheet and cost structure. The RSA contains certain covenants on the part of each of Gulfport and the Consenting Stakeholders, including commitments by the Consenting Stakeholders to vote in favor of the Plan and commitments of Gulfport and the Consenting Stakeholders to negotiate in good faith to finalize the documents and agreements governing the Restructuring. The RSA also places certain conditions on the obligations of the parties and provides that the RSA may be terminated upon the occurrence of certain events, including, without limitation, the failure to achieve certain milestones and certain breaches by the parties under the RSA. One such condition is the requirement of the Company to obtain certain levels of savings on certain midstream obligations (as set forth in the RSA) through rejection of such contracts and/or renegotiation of their terms.

Plan of Reorganization

On April 28, 2021, the Bankruptcy Court entered an order confirming the Amended Joint Chapter 11 Plan of Reorganization of Gulfport Energy Corporation and Its Debtor Subsidiaries (the "Plan"). The Company expects the effective

date of the Plan will occur once all conditions precedent to the Plan have been satisfied (the "Effective Date"). Below is a summary of the material terms of the Plan as approved and confirmed by the Bankruptcy Court. This summary highlights only certain substantive provisions of the Plan and is not intended to be a complete description of the Plan. Capitalized terms used under this heading but not otherwise defined herein shall have the meaning given to such terms in the Plan, which has been included as an exhibit to this Form 10-Q:

•the RBL Lenders and DIP Lenders, each with The Bank of Nova Scotia as administrative agent, have agreed that the RBL Credit Facility and DIP Facility, respectively, will convert into the $580 million Exit Facility upon the Effective Date, subject to the terms and conditions set forth in the Exit Facility Documentation;

•certain members of the Ad Hoc Noteholder Group have agreed to backstop the Rights Offering of at least $50 million in exchange for New Preferred Stock;

•Holders of Allowed General Unsecured Claims against Gulfport Parent will receive their Pro Rata share of: (a) $10 million in Cash, subject to adjustment by the Unsecured Claims Distribution Trustee; (b) 100% of the Mammoth Shares; and (c) 4% of the New Common Stock of the Reorganized Debtors, subject to dilution and certain adjustments;

•Holders of Allowed Notes Claims against Gulfport Parent will waive their entitlement to a Cash recovery or any of the Mammoth Shares, and will cap their recovery at 96% of the New Common Stock of the Reorganized Debtors, which will be drawn first from the Gulfport Subsidiaries Equity Pool and then from the Gulfport Parent Equity Pool to the extent required due to dilution as a result of distributions made to General Unsecured Claims against Gulfport Subsidiaries (excluding distributions to Unsecured Surety Claims);

•Holders of Allowed Notes Claims against Gulfport Subsidiaries and Allowed General Unsecured Claims against Gulfport Subsidiaries will receive their Pro Rata share of: (a) the Gulfport Subsidiaries Equity Pool; (b) the New Unsecured Notes; and (c) the Rights Offering Subscription Rights;

•a Class of Convenience Claims consisting of (a) Allowed General Unsecured Claims of $300,000 or less or (b) Allowed General Unsecured Claims over $300,000 that the applicable Holder has irrevocably elected to have reduced to $300,000 and treated as Convenience Claims, will share in a $3,000,000 Cash distribution pool, which the Unsecured Claims Distribution Trustee may increase by an additional $2,000,000 by reducing the Gulfport Parent Cash Pool;

•an Unsecured Claims Distribution Trustee will administer a trust to make distributions to Allowed General Unsecured Claims and Allowed Convenience Claims and to exercise certain consent rights with respect to the settlement and Allowance of disputed General Unsecured Claims and Convenience Claims;

•each Intercompany Claim shall be cancelled in exchange for the distributions contemplated by the Plan to Holders of Claims against and Interests in the respective Debtor entities and shall be considered settled pursuant to Bankruptcy Rule 9019;

•each Holder of an Intercompany Interest shall receive no recovery or distribution and shall be Reinstated solely to the extent necessary to maintain the Debtors’ prepetition corporate structure for the ultimate benefit of the Holders of New Common Stock and New Preferred Stock; and

•the Existing Interests in Gulfport Parent will be cancelled, released, and extinguished, and will be of no further force or effect, without any distribution.

DIP Credit Facility

Pursuant to the RSA, the Consenting RBL Lenders have agreed to provide the Company with a senior secured superpriority debtor-in-possession revolving credit facility in an aggregate principal amount of $262.5 million consisting of (a) $105 million of new money and (b) $157.5 million to roll up a portion of the existing outstanding obligations under the Pre-Petition Revolving Credit Facility. The proceeds of the DIP Credit Facility may be used for, among other things, post-petition working capital, permitted capital investments, general corporate purposes, letters of credit, administrative costs, premiums, expenses and fees for the transactions contemplated by the Chapter 11 Cases and payment of court approved adequate protection obligations. The DIP Credit Facility was approved by the Bankruptcy Court on a final basis on December 18, 2020. See Note 5 for additional information.

Executory Contracts

Subject to certain exceptions, under the Bankruptcy Code, the Company may assume, assign, or reject certain executory contracts and unexpired leases subject to the approval of the Bankruptcy Court and certain other conditions. Generally, the rejection of an executory contract or unexpired lease is treated as a pre-petition breach of such executory contract or unexpired lease and, subject to certain exceptions, relieves the Company from performing its future obligations under such executory contract or unexpired lease but entitles the contract counterparty or lessor to a pre-petition general unsecured claim for damages caused by such deemed breach. Counterparties to rejected contracts or leases may assert unsecured claims in the Bankruptcy Court against the Company's estate for such damages. Generally, the assumption of an executory contract or unexpired lease requires the Company to cure existing monetary defaults under such executory contract or unexpired lease and provide adequate assurance of future performance. Accordingly, any description of an executory contract or unexpired lease with the Company, including where applicable a quantification of the Company's obligations under any such executory contract or unexpired lease of the Company, is qualified by any overriding rejection rights it has under the Bankruptcy Code.

Potential Claims

The Company has filed with the Bankruptcy Court schedules and statements setting forth, among other things, the assets and liabilities of the Company and each of its subsidiaries, subject to the assumptions filed in connection therewith. These schedules and statements may be subject to further amendment or modification after filing. Certain holders of pre-petition claims that are not governmental units were required to file proofs of claim by the deadline for general claims, which was set by the Bankruptcy Court as January 26, 2021. Governmental units are required to file proof of claims by May 12, 2021, the deadline that was set by the Bankruptcy Court.

As of April 30, 2021, the Debtors have received approximately 2,700 proofs of claim for an aggregate amount of approximately $13 billion. The Company will continue to evaluate these claims throughout the Chapter 11 process and recognize or adjust amounts in future financial statements as necessary using the best information available at such time. Differences between amounts scheduled by the Company and claims by creditors will ultimately be reconciled and resolved in connection with the claims resolution process. In light of the expected number of creditors, the claims resolution process may take considerable time to complete and likely will continue after the Company emerges from bankruptcy.

Financial Statement Classification of Liabilities Subject to Compromise

The accompanying consolidated balance sheets as of March 31, 2021 and December 31, 2020 include amounts classified as liabilities subject to compromise, which represent liabilities the Company anticipates will be allowed as claims in the Chapter 11 Cases. These amounts represent the Company's current estimate of known or potential obligations to be resolved in connection with the Chapter 11 Cases, and may differ from actual future settlement amounts paid. Differences between liabilities estimated and claims filed, or to be filed, will be investigated and resolved in connection with the claims resolution process. The Company will continue to evaluate these liabilities throughout the Chapter 11 process and adjust amounts as necessary. Such adjustments may be material.

Liabilities subject to compromise includes amounts related to the rejection of various executory contracts. Additional amounts may be included in liabilities subject to compromise in future periods if additional executory contracts and/or unexpired leases are rejected. The nature of many of the potential claims arising under the Company's executory contracts and unexpired leases has not been determined at this time, and therefore, such claims are not reasonably estimable at this time and may be material. Damages related to rejected contracts are accounted for after they have been approved for rejection by the Bankruptcy Court.

The following table summarizes the components of liabilities subject to compromise included on the Company's consolidated balance sheets as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | |

| | March 31, 2021 | | December 31, 2020 |

| | (in thousands) |

| Debt subject to compromise | | $ | 2,003,004 | | | $ | 2,005,219 | |

| Accounts payable and accrued liabilities | | 134,344 | | | 164,939 | |

| Asset retirement obligations | | 64,854 | | | 63,566 | |

| Accrued interest on debt subject to compromise | | 55,159 | | | 55,634 | |

| Other liabilities | | 4,092 | | | 4,122 | |

| Liabilities subject to compromise | | $ | 2,261,453 | | | $ | 2,293,480 | |

Interest Expense

The Company has discontinued recording interest on debt instruments classified as liabilities subject to compromise as of the Petition Date. The contractual interest expense on liabilities subject to compromise not accrued in the consolidated statements of operations was approximately $28.5 million for the three months ended March 31, 2021.

Reorganization Items, Net

The Company has incurred and will continue to incur significant expenses, gains and losses associated with the reorganization, primarily the write-off of unamortized debt issuance costs, debt and equity financing fees, adjustments to allowed claims and legal and professional fees incurred subsequent to the Chapter 11 filings related to the restructuring process. The amount of these items, which are being incurred in reorganization items, net within the Company's accompanying audited consolidated statements of operations, are expected to significantly affect the Company's statements of operations. The Company has incurred adjustments for allowable claims related to its legal proceedings and executory contracts approved for rejections by the Bankruptcy Court, with additional adjustments possible in future periods.

The following table summarizes the components in reorganization items, net included in the Company's consolidated statements of operations for the three months ended March 31, 2021:

| | | | | | | | |

| | Three months ended March 31, 2021 |

| | (in thousands) |

| Legal and professional fees | | $ | 40,783 | |

| Adjustment to allowed claims | | 2,088 | |

| | |

| | |

| Gain on settlement of pre-petition accounts payable | | (4,150) | |

| Reorganization items, net | | $ | 38,721 | |

3.PROPERTY AND EQUIPMENT

The major categories of property and equipment and related accumulated DD&A and impairment as of March 31, 2021 and December 31, 2020 are as follows:

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In thousands) |

| Oil and natural gas properties | $ | 10,895,625 | | | $ | 10,816,909 | |

| Other depreciable property and equipment | 85,827 | | | 85,530 | |

| Land | 3,008 | | | 3,008 | |

| Total property and equipment | 10,984,460 | | | 10,905,447 | |

| Accumulated DD&A and impairment | (8,874,899) | | | (8,819,178) | |

| Property and equipment, net | $ | 2,109,561 | | | $ | 2,086,269 | |

Under the full cost method of accounting, the Company is required to perform a ceiling test each quarter. The test determines a limit, or ceiling, on the book value of the Company's oil and natural gas properties. At March 31, 2021, the net book value of the Company's oil and gas properties was below the calculated ceiling for the period leading up to March 31, 2021. As a result, the Company recorded no impairment of its oil and natural gas properties for the three months ended March 31, 2021. The Company recorded an impairment of its oil and natural gas properties of $553.3 million for the three months ended March 31, 2020.

Certain general and administrative costs are capitalized to the full cost pool and represent management’s estimate of costs incurred directly related to exploration and development activities. All general and administrative costs not capitalized are charged to expense as they are incurred. Capitalized general and administrative costs were approximately $5.5 million and $5.4 million for the three months ended March 31, 2021 and 2020, respectively.

The following table summarizes the Company’s unevaluated properties excluded from amortization by area at March 31, 2021:

| | | | | |

| March 31, 2021 |

| (In thousands) |

| Utica | $ | 761,397 | |

| SCOOP | 651,451 | |

| Other | 926 | |

| $ | 1,413,774 | |

At December 31, 2020, approximately $1.5 billion of unevaluated properties were not subject to amortization.

The Company evaluates the costs excluded from its amortization calculation at least annually. Individually insignificant unevaluated properties are grouped for evaluation and periodically transferred to evaluated properties over a timeframe consistent with their expected development schedule.

Impairment of Other Property and Equipment

During the three months ended March 31, 2021, the Company recorded an impairment of $14.6 million related to its corporate headquarters as a result of changes in the expected future use.

Asset Retirement Obligation

A reconciliation of the Company’s asset retirement obligation for the three months ended March 31, 2021 and 2020 is as follows:

| | | | | | | | | | | |

| March 31, 2021 | | March 31, 2020 |

| (In thousands) |

| Asset retirement obligation, beginning of period | $ | 63,566 | | | $ | 60,355 | |

| Liabilities incurred | 483 | | | 381 | |

| | | |

| Liabilities removed due to divestitures | — | | | (2,033) | |

| Accretion expense | 805 | | | 741 | |

| | | |

| Total asset retirement obligation as of end of period | $ | 64,854 | | | $ | 59,444 | |

| Less: amounts reclassified to liabilities subject to compromise | $ | (64,854) | | | $ | — | |

| Total asset retirement obligation reflected as non-current liabilities | $ | — | | | $ | 59,444 | |

| | | |

| | | |

4.EQUITY INVESTMENTS

Investments accounted for by the equity method consist of the following as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Carrying value | | Loss from equity method investments |

| Approximate ownership % | | March 31, 2021 | | December 31, 2020 | | Three months ended March 31, |

| | | | 2021 | | 2020 |

| | | (In thousands) |

| Investment in Grizzly Oil Sands ULC | 24.5 | % | | $ | 27,044 | | | $ | 24,816 | | | $ | (342) | | | $ | (143) | |

| Investment in Mammoth Energy Services, Inc. | 21.5 | % | | — | | | — | | | — | | | (10,646) | |

| | | | | | | | | |

| | | $ | 27,044 | | | $ | 24,816 | | | $ | (342) | | | $ | (10,789) | |

The tables below summarize financial information for the Company’s equity investments as of March 31, 2021 and December 31, 2020.

Summarized balance sheet information:

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| |

| (In thousands) |

| Current assets | $ | 462,478 | | | $ | 483,303 | |

| Noncurrent assets | $ | 1,079,557 | | | $ | 1,092,495 | |

| Current liabilities | $ | 125,359 | | | $ | 132,978 | |

| Noncurrent liabilities | $ | 124,628 | | | $ | 148,240 | |

Summarized results of operations:

| | | | | | | | | | | |

| | Three months ended March 31, |

| | 2021 | | 2020 |

| (In thousands) |

| Gross revenue | $ | 66,805 | | | $ | 97,383 | |

| Net loss | $ | (13,606) | | | $ | (85,031) | |

Grizzly Oil Sands ULC

The Company, through its wholly owned subsidiary Grizzly Holdings, owns an approximate 24.5% interest in Grizzly, a Canadian unlimited liability company. As of March 31, 2021, Grizzly had approximately 830,000 acres under lease in the Athabasca, Peace River and Cold Lake oil sands regions of Alberta, Canada. The Company reviewed its investment in Grizzly for impairment at March 31, 2021 and 2020 and determined no impairment was required. The Company has not paid any cash calls since its election to cease funding further capital calls in 2019. Grizzly’s functional currency is the Canadian dollar. The Company’s investment in Grizzly increased by $2.6 million as a result of a foreign currency translation gain and decreased by $14.7 million as a result of a foreign currency translation loss for the three months ended March 31, 2021 and 2020, respectively.

Mammoth Energy Services, Inc.

At March 31, 2021, the Company owned 9,829,548 shares, or approximately 21.5%, of the outstanding common stock of Mammoth Energy Services, Inc. ("Mammoth Energy"). The approximate fair value of the Company's investment in Mammoth Energy at March 31, 2021 was $52.3 million based on the quoted market price of Mammoth Energy's common stock.

At March 31, 2020, the Company's share of net loss of Mammoth was in excess of the carrying value of its investment. As such, the Company's investment value was reduced to zero at March 31, 2020. During the first quarter of 2021, the Company's

share of net loss of Mammoth continued to be in excess of the carrying value of its investment and, therefore, the Company's investment value remained at zero at March 31, 2021.

The Company received no distributions from Mammoth Energy during the three months ended March 31, 2021 and 2020, respectively. The loss from equity method investments presented in the table above reflects any intercompany profit eliminations.

5.LONG-TERM DEBT

Long-term debt consisted of the following items as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In thousands) |

| DIP credit facility | $ | 157,500 | | | $ | 157,500 | |

| Pre-petition revolving credit facility | 316,759 | | | 292,910 | |

6.625% senior unsecured notes due 2023 | 324,583 | | | 324,583 | |

6.000% senior unsecured notes due 2024 | 579,568 | | | 579,568 | |

6.375% senior unsecured notes due 2025 | 507,870 | | | 507,870 | |

6.375% senior unsecured notes due 2026 | 374,617 | | | 374,617 | |

| Building loan | 21,914 | | | 21,914 | |

| Total Debt | 2,282,811 | | | 2,258,962 | |

| Less: current maturities of long-term debt | (279,807) | | | (253,743) | |

| Less: amounts reclassified to liabilities subject to compromise | (2,003,004) | | | (2,005,219) | |

| Total Debt reflected as long term | $ | — | | | $ | — | |

Chapter 11 Proceedings

Filing of the Chapter 11 Cases constituted an event of default with respect to certain of our secured and unsecured debt obligations. As a result of the Chapter 11 Cases, the principal and interest due under these debt instruments became immediately due and payable. However, Section 362 of the Bankruptcy Code stays the creditors from taking any action as a result of the default.

The principal amounts from the Senior Notes, Building Loan and Pre-Petition Revolving Credit Facility, other than letters of credit drawn on the Pre-Petition Revolving Credit Facility after the Petition Date, have been classified as liabilities subject to compromise on the accompanying consolidated balance sheets as of March 31, 2021 and December 31, 2020.

Debtor-in-Possession Credit Agreement

Pursuant to the RSA, the Consenting RBL Lenders have agreed to provide the Company with a senior secured superpriority debtor-in-possession revolving credit facility in an aggregate principal amount of $262.5 million consisting of (a) $105 million of new money and (b) $157.5 million to roll up a portion of the existing outstanding obligations under the Pre-Petition Revolving Credit Facility. The terms and conditions of the DIP Credit Facility are set forth in that certain form of credit agreement governing the DIP Credit Facility. The proceeds of the DIP Credit Facility may be used for, among other things, post-petition working capital, permitted capital investments, general corporate purposes, letters of credit, administrative costs, premiums, expenses and fees for the transactions contemplated by the Chapter 11 Cases and payment of court approved adequate protection obligations. The DIP Credit Facility was approved by the Bankruptcy Court on a final basis on December 18, 2020. As of March 31, 2021, $157.5 million was outstanding under the DIP Credit Facility and the total availability for future borrowings under this facility, after giving effect to an aggregate of $28.5 million letters of credit, was $76.5 million.

Borrowings under the DIP Credit Facility will mature, and the lending commitments thereunder will terminate, upon the earliest to occur of: (a) August 30, 2021; (b) three (3) business days after the Petition Date, if the Interim Order and Hedging Order have not been entered prior to the expiration of such period; (c) thirty five (35) days (or a later date consented to by the Administrative Agent and the Majority Lenders in their sole discretion) after the entry of the Interim Order, if the Bankruptcy Court has not entered the Final Order on or prior to such date; (d) the effective date of an Approved Plan of Reorganization, (e)

the consummation of a sale of all or substantially all of the equity and/or assets of the Debtors and budgeted and necessary expenses of the estates; (f) the date of the payment in full, in cash, of all Obligations (and the termination of all Commitments in accordance with the terms hereof); and (g) the date of termination of all Commitments and/or the acceleration of all of the Obligations under the Agreement and the other Loan Documents following the occurrence and during the continuance of an Event of Default.

Borrowings under the DIP Credit Facility bear interest at a eurodollar rate or base rate, at our election, plus an applicable margin of 4.50% per annum for eurodollar loans and 3.50% per annum for base rate loans. At March 31, 2021, amounts borrowed under the DIP credit facility bore interest at a weighted average rate of 5.50%. In addition to paying interest on outstanding principal and letters of credit posted under the DIP Credit Facility, we are required to pay a commitment fee of 0.50% per annum to the lenders of the DIP Credit Facility in respect of the unutilized DIP commitments thereunder and a letter of credit fee equal to 0.20% per annum.

The DIP Credit Facility includes negative covenants that, subject to significant exceptions, limit the Company's ability and the ability of its restricted subsidiaries to, among other things, (i) create liens on assets, property revenues, (ii) make investments, (iii) incur additional indebtedness, (iv) engage in mergers, consolidations, liquidations and dissolutions, (v) sell assets, (vi) pay dividends and distributions or repurchase capital stock, (vii) cease for any reason to be the operator of its properties, (viii) enter into letters of credit without prior written consent, (ix) enter into certain commodity hedging contracts except commodity hedging contracts with terms approved by the Bankruptcy Court in the hedging order or certain interest rate contracts, (x) change lines of business, (xi) engage in certain transactions with affiliates and (xii) incur more than a certain amount in capital expenditures in any calendar month. The DIP Credit Facility includes certain customary representations and warranties, affirmative covenants and events of default, including but not limited to defaults on account of nonpayment, breaches of representations and warranties and covenants, certain bankruptcy-related events, certain events under ERISA, material judgments and a change in control. If an event of default occurs, the lenders under the DIP Credit Facility will be entitled to take various actions, including the acceleration of all amounts due under the DIP Credit Facility and all actions permitted to be taken under the loan documents or application of law. In addition, the DIP Credit Facility is subject to various other financial performance covenants, including compliance with certain financial metrics and adherence to a budget approved by the Company's DIP Credit Facility lenders.

Pre-Petition Revolving Credit Facility

The Company has entered into a senior secured revolving credit facility agreement, as amended, with The Bank of Nova Scotia, as the lead arranger and administrative agent and certain lenders from time to time party thereto. On October 8, 2020, the Company's borrowing base under its Pre-Petition Revolving Credit Facility was reduced from $700 million to $580 million, thereby significantly reducing the Company's available liquidity. On October 15, 2020, the Company elected to not pay interest on certain Senior Notes outstanding triggering a default under the credit agreement. There was $316.8 million of outstanding borrowings under the Pre-Petition Revolving Credit Facility as of March 31, 2021 that were not rolled up into the DIP Credit Facility. This amount of indebtedness will remain outstanding throughout the Chapter 11 Cases and will continue to accrue interest at the default interest rate on amounts drawn after the Petition Date. The Company made certain adequate protection payments of $2.2 million on its Pre-Petition Revolving Credit Facility during the three months ended March 31, 2021 which reduced the amount of outstanding borrowings under the Pre-Petition Revolving Credit Facility classified as liabilities subject to compromise as of March 31, 2021 in the accompanying consolidated balance sheets.

During the first quarter of 2021, $26.1 million was drawn on letters of credit secured by the Company's Pre-Petition Revolving Credit Facility by certain of its firm transportation contract counterparties. As these were post-petition activities, these letters of credit drawn are included in current portion of long-term debt in the accompanying consolidated balance sheets. At March 31, 2021 the Company included $99.1 million in prepaid and other current assets in the accompanying consolidated balance sheets as an offset for the drawn letters of credit. A portion of the drawn letters of credit were netted against accounts payable to the Company's firm transportation contract counterparties.

Additionally, as of March 31, 2021, the Company had an aggregate of $121.2 million of letters of credit outstanding and no availability for future borrowings under its Pre-Petition Revolving Credit Facility. This facility is secured by substantially all of the Company's assets. All of the Company's wholly-owned subsidiaries, excluding Grizzly Holdings and Mule Sky, guarantee our obligations under our revolving credit facility.

At March 31, 2021, amounts borrowed under the revolving credit facility bore interest at a weighted average rate of 3.12%.

Capitalization of Interest

The Company did not capitalize interest expense for the three months ended March 31, 2021 and capitalized approximately $0.2 million in interest expense related to its unevaluated oil and natural gas properties during the three months ended March 31, 2020.

Fair Value of Debt

At March 31, 2021, the carrying value of the outstanding debt represented by the Notes was approximately $1.8 billion. Based on the quoted market prices (Level 1), the fair value of the Notes was determined to be approximately $1.6 billion at March 31, 2021.

6.STOCK-BASED COMPENSATION

The Company has granted restricted stock units to employees and directors pursuant to the 2019 Amended and Restated Incentive Stock Plan ("2019 Plan"), as discussed below. During the three months ended March 31, 2021, the Company’s stock-based compensation cost was $3.0 million, of which the Company capitalized $0.6 million relating to its exploration and development efforts. During the three months ended March 31, 2020, the Company’s stock-based compensation cost was $2.1 million of which the Company capitalized $0.9 million relating to its exploration and development efforts. Stock compensation costs, net of the amounts capitalized, are included in general and administrative expenses in the accompanying consolidated statements of operations.

The following table summarizes restricted stock unit activity for the three months ended March 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of

Unvested

Restricted Stock Units | | Weighted

Average

Grant Date

Fair Value | | Number of

Unvested

Performance Vesting Restricted Stock Units | | Weighted

Average

Grant Date

Fair Value |

| Unvested shares as of January 1, 2021 | 1,702,513 | | | $ | 4.74 | | | 840,595 | | | $ | 4.07 | |

| Granted | — | | | — | | | — | | | — | |

| Vested | (202,583) | | | 8.32 | | | — | | | — | |

| Forfeited/canceled | (19,707) | | | 3.61 | | | — | | | — | |

| Unvested shares as of March 31, 2021 | 1,480,223 | | | $ | 4.26 | | | 840,595 | | | $ | 4.07 | |

Restricted Stock Units

Restricted stock units awarded under the 2019 Plan generally vest over a period of one year in the case of directors and three years in the case of employees and vesting is dependent upon the recipient meeting applicable service requirements. Stock-based compensation costs are recorded ratably over the service period. The grant date fair value of restricted stock units represents the closing market price of the Company's common stock on the date of grant. Unrecognized compensation expense as of March 31, 2021 related to restricted stock units was $4.0 million. The expense is expected to be recognized over a weighted average period of 1.12 years.

Performance Vesting Restricted Stock Units

The Company has awarded performance vesting units to certain of its executive officers under the 2019 Plan. The number of shares of common stock issued pursuant to the award will be based on relative total shareholder return ("RTSR"). RTSR is an incentive measure whereby participants will earn from 0% to 200% of the target award based on the Company’s RTSR ranking compared to the RTSR of the companies in the Company’s designated peer group at the end of the performance period. Awards will be earned and vested over a performance period measured from January 1, 2019 to December 31, 2021, subject to earlier termination of the performance period in the event of a change in control. Unrecognized compensation expense as of March 31, 2021 related to performance vesting restricted shares was $1.1 million. The expense is expected to be recognized over a weighted average period of 1.04 years.

2020 Cash Retention Incentives

On August 4, 2020, the Company's Board of Directors authorized a redesign of the incentive compensation program for the Company's workforce, including for its current named executive officers. In connection with a comprehensive review of the Company’s compensation programs and in consultation with its independent compensation consultant and legal advisors, the Board of Directors determined that significant changes were appropriate to retain and motivate the Company’s employees as a result of the ongoing uncertainty and unprecedented disruption in the oil and gas industry.